The Kenyan banking sector remained stable and agile in 2020 despite the COVID-19 pandemic.

The year was characterised by restrictions on movement through lockdowns and curfew hours. The sector ramped up their online/mobile platforms to continue offering banking services amid the pandemic and at the same time ensured that the channels remained secure and available.

Despite the effect of the COVID-19 pandemic, the sector’s gross loans and advances increased by 7.2 per cent from Ksh.2.7 trillion in December 2019 to Ksh.2.9 trillion in December 2020. All the economic sectors registered growth in loans other than Mining and Quarrying that had a slight decline. The highest proportion of the banking industry gross loans and advances was channelled to the Personal/Household, Trade, Real Estate and Manufacturing sectors.

The Central Bank of Kenya’s Bank Supervision annual report (2020), which highlights the structure of the Kenyan banking sector and banking sector performance, showed that:

Read: Global economy on track for strong but uneven growth as Covid-19 still weighs – World Bank

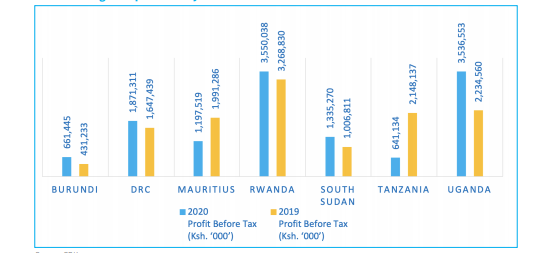

- Rwanda continues to dominate the East African region as the most profitable banking market for Kenyan lenders for the third year in a row, signalling increased investment into one of Africa’s fastest-growing economies.

- Rwanda contributed the highest earnings capacity, recording Ksh.3.55 billion in profits, translating to 27.75 per cent of the total profits. The regional subsidiaries profit before tax stood at Ksh.12.79 billion as of December 31, 2020, an increase of 0.51 per cent from Ksh.12.72 billion reported on December 31, 2019. The negative impact of the COVID-19 pandemic that continues to disrupt growth in global markets has impaired the profitability of Kenyan banks across borders.

- Other African banks, including Nigerian tier 1 giant, Access Bank Plc, have also shown huge interest in the East African region following the acquisition of an additional 16.22 per cent shareholding in its Rwandan subsidiary valued at $9.55 million, thereby growing its stake in the Rwandan unit to 91.22 per cent from 75 per cent.

- Subsidiaries operating in Tanzania were the least profitable and contributed 5 per cent of the total profits of combined subsidiaries in all host countries. The performance in Tanzania was affected by losses reported by some subsidiaries attributed to provisions for loan losses.

- Three subsidiaries registered a combined loss of Ksh.978.5 million. Out of the three loss-making subsidiaries, two were operating in Tanzania and one in Rwanda.

Also: El Salvador becomes first country to adopt bitcoin as legal tender after passing law

Gross Loans

The combined gross loans for the subsidiaries in the host countries stood at Ksh.421.1 billion as of December 31, 2020, an increase of 25.2 per cent from Ksh.336.4 billion as of December 31, 2019. The Kenyan banks’ subsidiaries operating in Tanzania recorded the highest level of gross loans at Ksh.105 billion, accounting for 25 per cent of gross loans in all the subsidiaries outside Kenya.

This was followed by subsidiaries operating in DRC, which accounted for 23 per cent of the gross loans. Uganda and Rwanda accounted for 18 per cent and 17 per cent of the gross loans, respectively. Mauritius recorded gross loans of Ksh.62 billion, accounting for 15 per cent of gross loans.

The banking sector is projected to remain stable and sustain its growth momentum in 2021 as the outcomes of various reform initiatives in the banking sector continue to manifest. Furthermore, banks are expected to review their business models for agility in the “anytime anywhere” financial services era.