Cedi regains 33% of lost value to dollar in 2 weeks; now GHS 10 to $1

The local currency (cedi), within a span of 14 days has regained over 33% of its lost value to the dollar.

This is after the cedi recorded a depreciation rate of close to 60% against the dollar in the latter days of the month of November 2022.

The fast appreciation of the cedi against the dollar, has made the local currency the best performing currency against the American greenback.

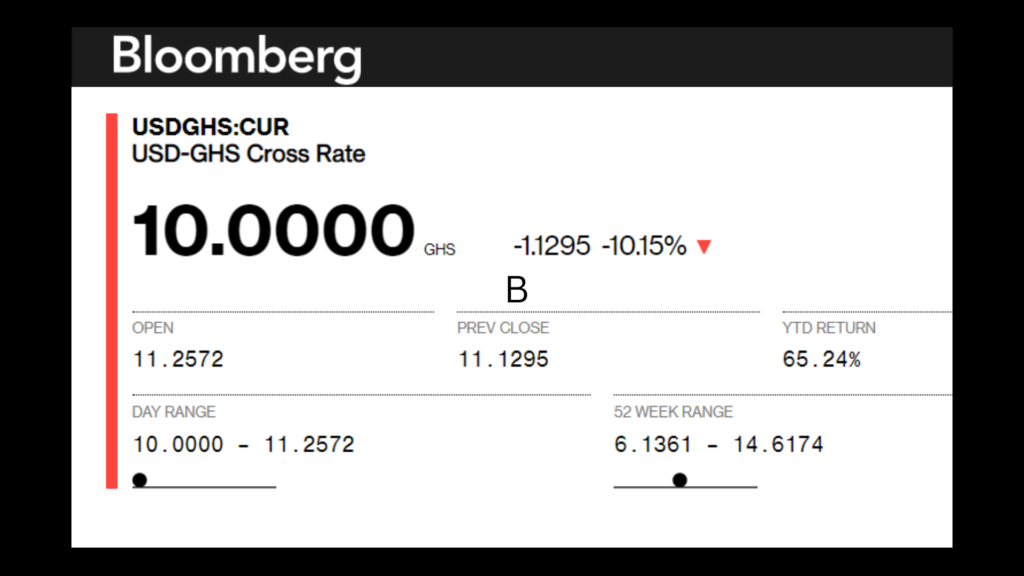

According to Bloomberg, the cedi as at Wednesday evening was trading at GHS 10 to $1.

This is despite opening the day with an exchange rate of GHS 11.25 to $1.

On Wednesday alone, the dollar took a nosedive giving the cedi the advantage to appreciate by some 12% to reach the now GHS 10 to $1 exchange rate.

The strengthening of the cedi against its anchor currency – dollar – begun on December 1, 2022 when the IMF Mission Staff led Stephane Roudet arrived in the country to continue discussions on reaching a Staff-Level Agreement (SLA).

It continued its resurgence when the country’s Finance Chief, Ken Ofori-Atta, announced the government’s Domestic Debt Exchange Programme (DDEP) on December 5, 2022, indicating government’s willingness to restore the country’s debts to a sustainable level.

A Staff-Level Agreement (SLA) reached on Monday, December 12, 2022, further strengthened the cedi’s resurgence against the greenback, aiding the cedi to regain 40% of its lost value.

Aside the SLA being a factor to the cedi’s resurgence against the dollar, some experts have also attributed the strong appreciation of the cedi against the dollar to US Fed monetary policy easing and investors turning bearish on the dollar for the first time since July 2021, as possible factors fueling the dollar’s continuous depreciation against the Cedi.