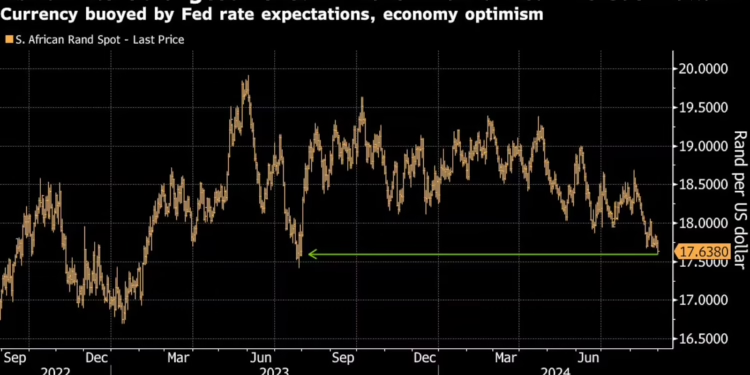

South Africa’s Rand Surges to 13-Month High on Economy Optimism

The rand climbed to a 13-month high on Friday, riding a wave of optimism about South Africa’s economy and also buoyed by expectations of imminent Federal Reserve interest-rate cuts.

The South African currency advanced as much as 0.8% on Friday to 17.6069 per dollar, the strongest level since July 2023 and bringing its gain this year to 4.3%, the most in emerging markets after Malaysia’s ringgit.

Investors are looking more favorably at South African assets following the May 29 election, which saw the African National Congress enter into a coalition with the main opposition Democratic Alliance and smaller parties. That raised expectations of much-needed reforms to stimulate the economy. With crippling electricity outages — known as load-shedding — also easing, the outlook for the economy is bright, said Razia Khan, chief economist for Africa and the Middle East at Standard Chartered Plc.

Expectations of Fed policy easing starting next month are also prompting investors to look for higher-yielding assets such as South African rand bonds. That’s seen net inflows of 16.4 billion rand ($930 million) into the country’s debt market in the past five days, according to JSE Ltd. data compiled by Bloomberg.

“The end to load-shedding has improved South Africa’s growth outlook, while disinflation is now in place – the cumulative impact of earlier tightening,” said Khan. “When we add to this the favorable impact of Fed easing expectations, everything falls into place for a sustained rand rally.”

The end to regular power outages may lead to an upward revision to economic-growth forecasts and help in the fight against inflation, South African Reserve Bank Deputy Governor Rashad Cassim said on Thursday.

The SARB currently expects the economy to grow 1.1% in 2024 and 1.5% next year, and forecasts inflation to slow to below the 4.5% midpoint of its target range where it prefers to anchor expectations in the fourth quarter.

The central bank is seen cutting its benchmark rate by about 123 basis points over the next year, according to forward-rate agreement pricing. The Fed is seen reducing rates by more than 200 basis points over the same period, widening the rate differential in the rand’s favor.

With rand volatility also moderating, that makes the South African currency attractive in the carry trade, where investors borrow low-yielding currencies such as the dollar to invest in higher-returning assets. Government rand bonds have returned 5.4% for dollar investors in August, compared with the 2.3% average return for emerging-market local-currency debt, according to Bloomberg indexes.

South Africa’s 10-year government bond yield has dropped about 85 basis points this quarter to reach an 18-month low on Thursday. At around 10.55%, that’s still among the highest in developing nations, leaving room for further bond gains.

“The downside risk has meaningfully reduced as fiscal consolidation is a fundamental tenet of the newly established government of national unity in South Africa, with the risk of a shift to the left and fiscal deterioration avoided,” said Annabel Bishop, chief economist at Investec Bank Ltd. “Positive investor sentiment toward South Africa persists, particularly from foreign investors.”