Saudi Arabia borrows $12 billion as EM nations load up on bonds

Saudi Arabia sold $12 billion of debt in its largest borrowing abroad since 2017 amid a record start to a year for emerging-market countries.

The kingdom added to the almost $25 billion of bonds that developing nations had sold since the start of the year, the biggest of those being a $7.5 billion offering from Mexico. The Saudi deal is equivalent to more than half the fiscal deficit the government is projecting for this year.

Many borrowers are seeking to lock in lower funding costs following a steep drop in US Treasury yields since October. While the Federal Reserve is widely expected to start cutting interest rates this year, pushing down yields even more, that probably won’t happen for several months.

The kingdom sold six-, 10- and 30-year notes with respective yields of 4.89%, 5.13% and 5.91%. Ten-year US Treasuries trade around 4%. Citigroup Inc., JPMorgan Chase & Co., HSBC Holdings Plc and Standard Chartered Plc were the main banks managing the Saudi sale.

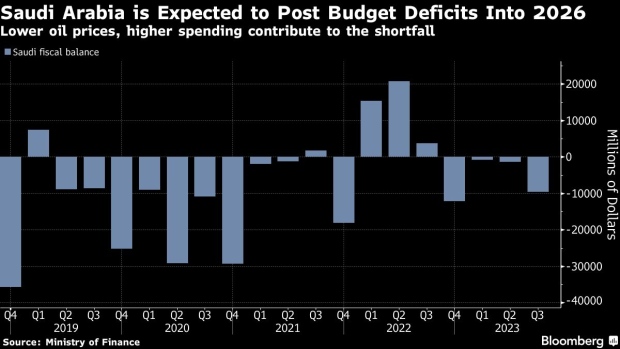

Until a few months ago, the world’s biggest oil exporter was expecting to post fiscal surpluses until at least 2025. But it’s had to revise those forecasts with crude prices trading far below what it needs to balance its budget.

Many analysts have a more bearish outlook that the government. Khatija Haque, chief economist at Emirates NBD Bank PJSC, said the Dubai lender is forecasting a budget deficit of about 4.3% of gross domestic product in 2024 and more than $46 billion of funding requirements.

The new bond “is probably about a quarter of what they’ll need to issue in total” from all capital markets, Haque said to Bloomberg Television. Still, the country’s stock of debt is “very low” and there’s “plenty of scope for the government to raise capital.”