Short-Term Debt Oversubscribed as Government Secures GHS 3.43bn in T-Bill Sale

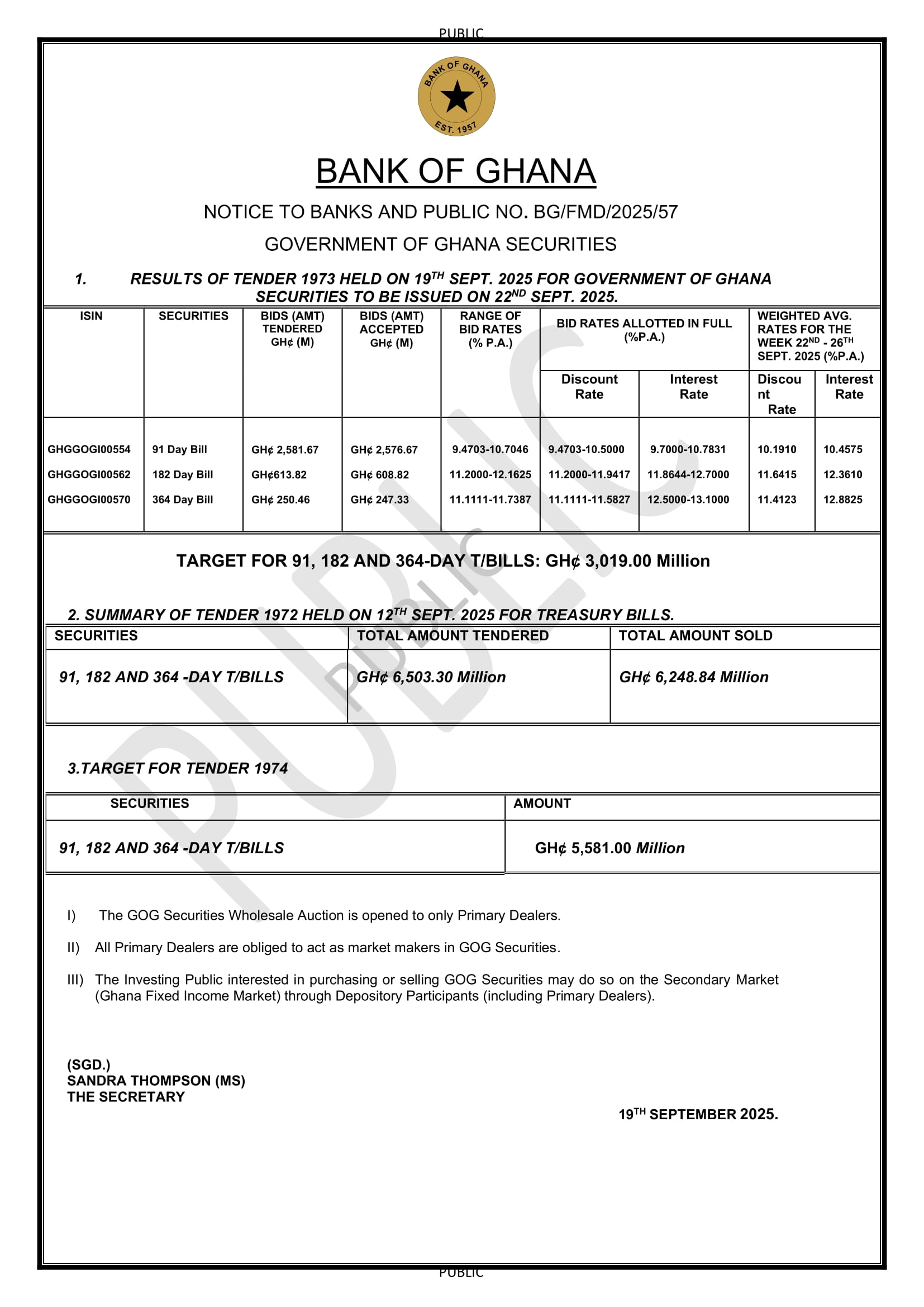

Government raised GHS 3.43 billion in its latest Treasury bill auction, exceeding its target of GHS 3.01 billion by GHS 412 million, according to data released by the Bank of Ghana.

The strong demand marks a reversal from the previous week’s undersubscription, signalling renewed investor appetite for short-term government securities amid tighter liquidity conditions in the broader economy.

Total bids submitted reached GHS 3.44 billion, with the government accepting nearly all at GHS 3.43 billion.

Yields drifted lower across maturities as the benchmark 91-day bill cleared at 10.45 per cent, down from 10.53 per cent a week earlier, while the 182-day instrument slipped to 12.36 per cent from 12.44 per cent. The 364-day paper edged down to 12.88 per cent from 12.95 per cent.

The next issuance, scheduled for September 26, aims to raise GHS 5.58 billion, underscoring the state’s dependence on the short-term debt market to roll over maturing obligations and ease financing pressures.

Analysts warn that this reliance highlights Ghana’s continued fiscal strain, even as the government benefits from strong participation by domestic investors.