Signs are mounting that a debt crunch is looming

Just when it seemed the US regional banking strains were starting to ease, First Republic Bank has leaped back into headlines, reigniting concerns of rising pain in the lending system.

Banks increased emergency borrowing from the Federal Reserve for the second week in a row in a sign of the ongoing stress in the system. Last week, the New York Fed reported that financial conditions in its region had deteriorated sharply.

The trouble is rekindling concern that a credit crunch is underway. And it further complicates the plan for next week’s Fed policy meeting, where officials have to figure out how to balance the risks of tighter borrowing conditions against stubbornly high inflation.

Below are six charts that help explain why and how borrowing is getting harder in vast parts of the economy:

Lending Contraction

“Lending from U.S. banks is poised to contract over the next few quarters,” Amanda Lynam, head of macro credit research at BlackRock Financial Management wrote in a note on Thursday. Headwinds to profitability including higher deposit costs have seen bank spreads underperform relative to non-financials, she wrote.

Money Supply

The blow to credit availability comes as the money supply shrinks, a sign that the spike in interest rates by the Fed is causing money to exit the banking system, shrinking the availability of loans. That could slow the economy, with monetarist economists suggesting it could herald a crash and deflation.

The Dallas Fed and the San Francisco Fed last week reported pressure on funding in their geographic regions, with projects being canceled and nonperforming loans expected to increase.

Consumer Headwinds

Banks that posted quarterly results this month said they boosted provisions on bad consumer loans to levels not seen since the early days of the pandemic. For example, Capital One Financial Corp. increased its provision for credit card losses by more than 300% to $2.26 billion compared with a year earlier. The firms have generally said the rising provisions are just consumers returning to pre-pandemic norms.

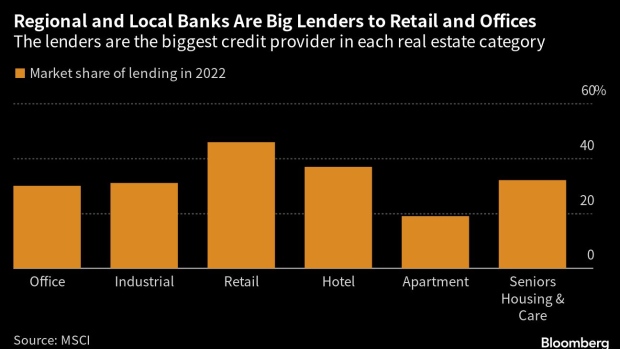

Office Woes

Capital One also set aside more money to cover souring office loans, as vacancies rise and many workers choose to work from home. Morgan Stanley has previously estimated that office property valuations could fall as much as 40% from peak to trough, increasing the risk of defaults.

Another emerging source of stress in credit is the leveraged loan market as corporate borrowers with floating-rate debt struggle to keep pace with higher borrowing costs.

Higher Defaults

The amount of loans trading at distressed prices, defined as below 80% of face value, has jumped 26% to about $127 billion since the end of February, according to data compiled by Bloomberg. That compares with a 10% increase for bonds to about $488 billion.

“We believe the loan market, which has historically had a lower default rate than the high yield bond market, will record a higher rate during this cycle,” Armen Panossian and Danielle Poli, managing directors at Oaktree Capital Management LP, wrote in a memo last week. “This is due to the covenant-lite nature of most loans and the rising prevalence of loan-only capital structures.”

Credit Chatter

Company executives worldwide, meanwhile, are talking about credit on conference calls at the highest rate since the pandemic hit, according to data compiled by Bloomberg News. Some mentions include Evercore Inc.’s Chief Executive Officer John Weinberg noting an increase in restructuring and liability management business and Peabody Energy Corp. investor relations vice president Karla Kimrey saying the company has positioned itself to avoid uncertain credit markets.