SMEs squeezed as banks revise interest on loans

Small and medium enterprises (SMEs) in Nigeria that took loans from deposit money banks (DMBs) before the bumper hike in the key interest rate last year are getting more than they bargained for as interest payments have surged.

The Monetary Policy Committee of the Central Bank of Nigeria increased the monetary policy rate (MPR), also known as the benchmark interest rate, four times last year from 11.5 percent in May to 16.5 percent in November in a bid to curb inflation.

Consequently, most DMBs re-priced their assets in response to the high interest rate environment. Usually, banks respond to MPR changes, according to experts. Commercial banks currently charge rates ranging between 28 and 35 percent, according to BusinessDay findings.

After the rate hikes, some banks revised the interest rates on old loan obligations to as high as 30 per annum.

“Based on the foregoing, we are constrained to notify you of an increase in the lending rate of the facilities availed to you by the bank from 26 percent to 30 percent. The new rates shall be effective from September 1st, 2022,” Access Bank said in a notice to its customers.

“We appreciate the impact that this rate change could have on the cost of your business operations and shall make necessary rate adjustments as market conditions change.”

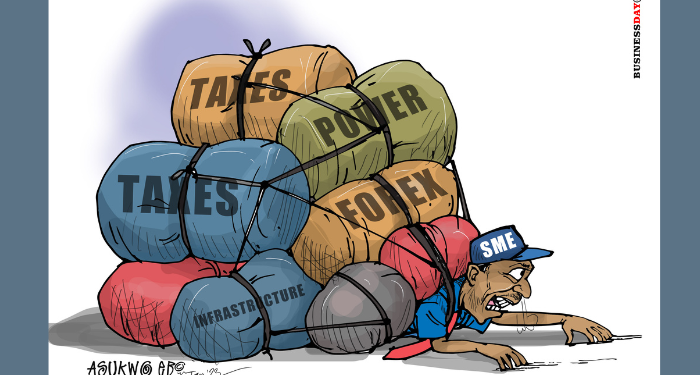

With the excessively high rates and less liquidity in the banks, amid the cost-of-doing-business crisis faced by small businesses, experts say more micro, small and medium enterprises (MSMEs) will be unable to service their loans, especially those from DMBs.

“Loan default among small businesses is on the rise as banks are adjusting their loan interest to as high as 30 to 35 percent in line with MPR,” said Femi Egbesola, national president of the Association of Small Business Owners of Nigeria (ASBON).

“How can a business survive with 30 percent interest rate?” he asked, saying that he understands that the rate hike is to control inflation, but “it shouldn’t be at the detriment of small businesses.”

According to him, many small businesses are unable to service their loans because they cannot afford to do so owing to the multiple challenges facing them daily.

“The association currently has over 20 cases of its members that have defaulted on servicing their loans and the banks are threatening to take over their businesses,” Egbesola said.

He said ASBON is working with them to ensure that their businesses are not taken over by the banks and that they start servicing their loans.

“I have been unable to service my loan for two months now, and this is because of the numerous challenges we are experiencing as a business,” said William Aguso, the owner of a shoe-making business in Idumota, Lagos. “These challenges are making it difficult for us to operate at full capacity and be profitable, thus unable to pay my loan obligation.”

“Last year, I received a letter from my bank twice giving me a new interest rate owing to the hike in the country’s MPR rate, so this constant hike in rates is also making it difficult for us as a business to service our debt,” he added.

The continued surge in the prices of key inputs, fuel, transportation and electricity since 2022 amid a worsening foreign exchange scarcity and insecurity in the country has doubled operating costs for small businesses, leaving many in an unprecedented financial battle for survival.

According to a report by the National Bureau of Statistics and the Small and Medium Enterprises Development Agency of Nigeria, the number of MSME operators in the country declined by 4.3 percent from 41.5 million in 2017 to 39.7 million in 2020.

Their contribution to GDP for the period also declined from 50 percent in 2017 to 46.3 percent. Experts say there would be a further drop when the figure for 2022 is released.

Commenting on the impact of assets repricing on SMEs, Ayodeji Ebo, managing director/chief business officer at Optimus by Afrinvest, said: “This means high cost of finance for the SMEs, which will compound the burden of a higher cost of doing business. This will ultimately impact their profitability and may lead to slower business activities.”

Ayodele Akinwunmi, relationship manager, corporate banking at FSDH Merchant Bank Limited, said the assets repricing by banks result in rising funding costs.

He said if the SMEs are not able to pass the costs to the consumers in terms of prices of goods, it will reduce their profit margins.

“Monetary policy tightening will continue, the lending rate will remain high, and investment will be constrained,” the Nigerian Economic Summit Group (NESG) said in its 2023 Macroeconomic Outlook report.

The NESG said a tight policy stance in developed economies leads to capital flight from developing and emerging markets and inflationary pressure will highlight the need for further tightening to close the interest rate differential and rein in inflation.

It said this could heighten financial risk and increase non-performing loans in the banking system.

“Monetary tightening in 2022 has signalled an upward trend in interest rates. In addition, a faster increase in credit to the government will reduce credit availability to the private sector, thereby supporting further increases in the cost of borrowing,” it said.