South Africa Cautious on Rates to Avoid ‘Regret’

South African Reserve Bank Governor Lesetja Kganyago said policymakers were proceeding with care on adjusting interest rates, to avoid feeling remorse in the future.

“In an environment of uncertainty, it is very important for the central bank to move with caution and not add to the noise that you have in the data,” Kganyago said on Monday in an interview with CNBC Africa. “We should not be creating uncertainty by making moves that we would later regret.”

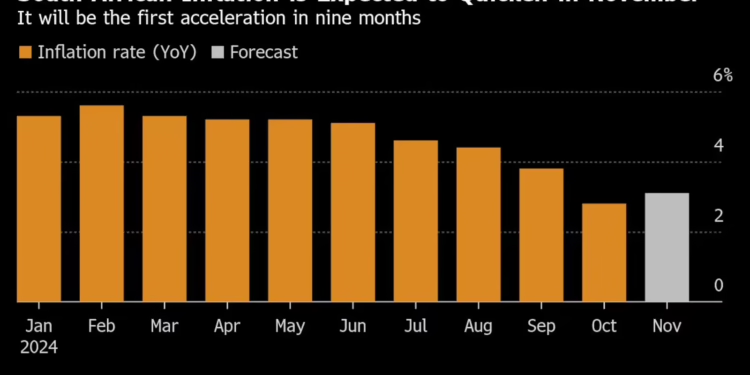

The central bank last month lowered its key interest rate by 25 basis points to 7.75%, even as some analysts called for a bigger cut after South Africa’s annual inflation cooled by more than expected to 2.8% in October.

Kganyago said the monetary policy committee didn’t focus on the October data as it was already out of date. “You do not make policy on the past,” he said. “You make policy on the future.”

The median estimate of 14 economists in a Bloomberg survey is for November inflation to quicken to 3.1% when the data is published Wednesday, due to higher gasoline prices and a weaker domestic currency.

The rand, a bellwether for emerging market currencies, has depreciated almost 3% against the dollar since Donald Trump won the US election on Nov. 5.

Investors are betting that his policies on tariffs and tax cuts may see the Federal Reserve lower rates by less than forecast. That could keep the US currency strong, which is bad news for South Africa as it makes its imports more expensive, adding to domestic price pressures.

‘Moving Parts’

“There are so many moving parts and we are not clear about what is going to happen to the global economy as a result of changes in policies that we are not even aware of,” Kganyago said.

Last month’s rate reduction was the second since the MPC commenced an easing cycle in September. But the central bank’s policy benchmark still stands 4.95 percentage points above annual inflation, and Kganyago acknowledged that rates remain tight.

“Without a doubt monetary policy is still in restrictive territory, by whichever measure that you use, and it is exactly that, that had provided us with the ability to reduce the policy rate and provide support,” he said.

Inflation Target

The governor also repeated his call for a lower inflation target, though he declined to say when an ongoing review between the SARB and the Treasury would be complete.

The central bank aims to anchor inflation around the midpoint of its 3% to 6% target band, which was adopted in 2000 and has not been reviewed since. Kganyago said the goal was high relative to South Africa’s peers and this made the country less competitive.

“What is in no doubt is what the median for emerging markets is: The median for emerging markets is around 3% and for developed countries it’s at 2%,” Kganyago said. “Inflation at levels above those of our peers, I’m afraid, does not begin to define price stability.”