South America to Anchor Non-OPEC+ Oil Supply Through 2030

Oil production from offshore Brazil, Guyana and Suriname, as well as Argentina’s Vaca Muerta shale is well-positioned to supply cost-competitive barrels until 2030. Global oil demand is expected to remain robust throughout the 2030s, putting pressure on currently producing assets to keep pace. Rystad Energy’s research forecasts global liquids demand to peak in the early 2030s at around 107 million barrels per day (bpd), remaining above 100 million bpd through the 2040s before gradually declining to about 75 million bpd by 2050. Non-OPEC+ supply will be key to balancing the market, with South America playing a central role by delivering cost-competitive barrels even at low prices, offsetting slower US shale growth.

Today’s wells are projected to deliver less than half of their current output by 2030, underscoring the need for continued investment in both new and existing fields. While additional volumes can be brought online, undeveloped and discovered fields will remain important sources of supply through the mid-2030s. Although the market may experience a brief period of oversupply, above-surface risks could trigger delays in project timelines. South America is well-positioned to offer competitive barrels to a global market due to its success with deepwater projects. Looking ahead, continued investment and a stronger focus on deepwater expansion as the supply gap might widen after the mid-2030s.

Radhika Bansal, vice president, Upstream research, Rystad Energy

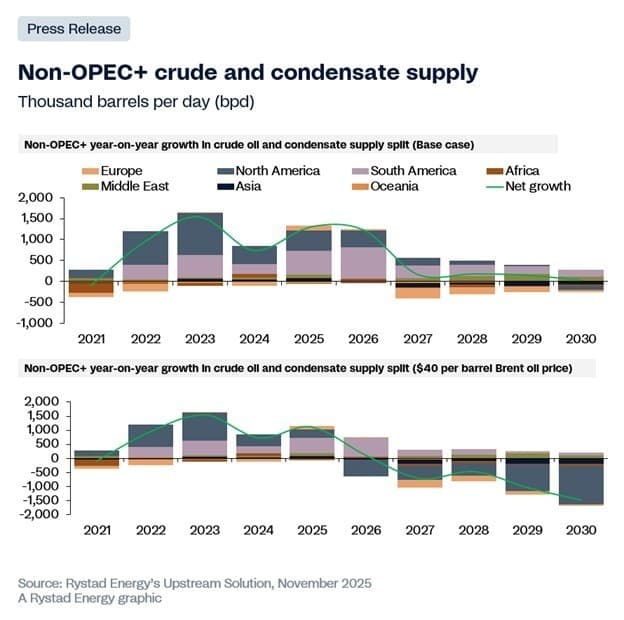

Nearly 60% of conventional under-development and discovered volumes, close to 5.9 million bpd, is expected from non-OPEC+ producers through 2030. South America will lead supply growth this year, adding over 560,000 bpd of crude and condensate, followed by North America with around 480,000 bpd. By 2026, South America’s additions should exceed 750,000 bpd, keeping the region among the few regions with additions over 500,000 bpd, alongside the Middle East (outside OPEC+), driving non-OPEC+ growth.

Offshore oilfields which have come online since 2020, and those set to start up by 2030, will account for over 65% of South America’s conventional production. This growth is supported by the increasing use of floating production, storage and offloading (FPSO) vessels, led primarily by developments in Brazil and Guyana. In Guyana, ExxonMobil has advanced multiple discoveries, with four FPSOs already in production, demonstrating effective project execution. However, the pace of new discoveries has slowed, with approximately 420 million barrels of liquids discovered over the past year, the lowest level since 2017, highlighting the ongoing need for exploration. Rystad Energy’s base case projections sees oil demand expected to outpace current supply by the mid-2030s, amplifying the need for renewed exploration and enhanced recovery; an area where South America is well positioned to play a key role.

The region’s future will also heavily depend on sanctioning activity. South America will maintain a strong final investment decision (FID) momentum through 2030, leading to a cumulative conventional greenfield capital expenditure (capex) for oilfields between 2020 and 2030 of $197 billion, largely concentrated in offshore deepwater projects. While Brazil and Guyana account for most of these investments, Suriname’s $10.5 billion GranMorgu field (formerly Sapakara South and Krabdagu), is slated to come online by 2028.

Total upstream investment in South American oilfields reached over $46 billion last year, the highest level since 2015. This year, investments are expected to grow by 10% before tapering slightly in the following years, stayuing close to $50 billion throughout the next decade. Greenfield investments will be led by Brazil and Guyana’s yet-to-produce assets. Already producing fields in Argentina, Brazil and Colombia will drive brownfield spending.

South America’s upstream sector occupies a pivotal role in the global energy landscape, having contributed substantially to conventional production and new discoveries over the past decade. The region has been a consistent driver of net oil exports and is set to remain crucial in the years ahead, with Argentina, Guyana, Suriname and Venezuela leading the charge. Brazil, Colombia and Ecuador are also expected to sustain meaningful export contributions at least through the mid-2030s. With adequate investment in exploration, there remains considerable upside potential, as new discoveries could unlock future volumes and enhance recoverable resources from existing fields.

Two countries that may receive less attention but show potential are Trinidad and Tobago and Peru. ExxonMobil has made a strategic re-entry into Trinidad and Tobago, one of the Caribbean’s least-explored ultra-deepwater frontiers, through a new production-sharing contract (PSC). Using a similar exploration approach that identified over 13 billion barrels of recoverable resources in Guyana’s Stabroek Block, ExxonMobil aims to replicate this model. If new discoveries are made, the company could invest more than $20 billion, signaling continued interest in frontier deepwater exploration.

In Peru, offshore northern basins are emerging as a promising exploration area. A consortium of Chevron, Anadarko (Occidental Petroleum), and Westlawn has recently partnered to explore three offshore blocks, Z-61, Z-62, and Z-63, in the Mar de Grau, off northern La Libertad. Successful exploration could add significant new reserves, where a commercial discovery could yield between 100,000 and 150,000 barrels per day in peak production.