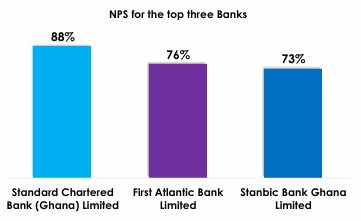

Standard Chartered Leads Net Promoter Score Rankings in 2025 Brand Health Survey

Standard Chartered Bank has emerged as the leader in customer loyalty and referrals in Ghana’s banking sector, topping the Net Promoter Score (NPS) matrix with an average score of 88%, according to the 2025 Customer Satisfaction and Brand Health Report jointly released by Global Infoanalytics and Stratcomm Africa.

The report, which surveyed 3,000 banking customers across all 16 regions, positions First Atlantic Bank and Stanbic Bank in second and third place with NPS scores of 76% and 73%, respectively.

NPS, a global metric for gauging customer loyalty and the likelihood of customer referrals, is calculated as the difference between promoter and detractor scores.

“Loyal customers are among a company’s most valuable assets,” the report noted, emphasizing the correlation between high NPS scores and sustainable customer relationships.

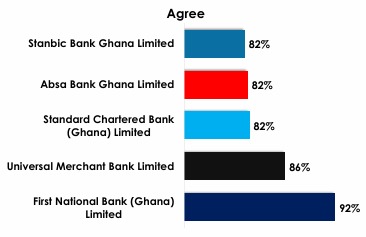

In the area of Brand Loyalty, Standard Chartered Bank scored 82% ranking third behind Universal Merchant Bank and First National Bank with scores of 86% and 92% respectively.

Brand loyalty, the report noted, reflects the consistency of customers’ preference for maintaining long-term relationships with their primary bank—a sentiment often driven by trust, satisfaction, and positive brand experiences.

The survey’s Customer Satisfaction component evaluated service quality using the SERVPERF model, assessing banks across five key dimensions: Tangibles, Reliability, Responsiveness, Assurance, and Empathy. These indicators, according to the report, play a central role in influencing satisfaction and, by extension, loyalty and business performance.

The Brand Health Survey section also assessed banks using metrics such as Unprompted Brand Recall, Purchase Intent, Brand Visibility, Brand Equity, and Net Promoter Score (NPS), providing a comprehensive overview of customer perception within an increasingly competitive financial services market.

The findings serve as a strategic guide for financial institutions seeking to improve customer engagement, refine service delivery models, and strengthen brand equity in an era where consumer preferences are rapidly evolving.