Stepping up to meet low-income countries’ pandemic recovery needs

Low-income countries have been hard hit by the pandemic. Their large financing needs are only likely to grow as they deal with the crisis and its economic aftermath.

The IMF has approved a far-reaching package of support that would expand their access to financial assistance at zero-interest rates, while providing stronger safeguards against taking on debt they cannot handle. For these efforts to succeed, economically stronger member countries will have to play their part.

A rapid, unprecedented response

The pandemic has dealt a severe blow to the economies of many low-income countries: output growth stopped or reversed, living standards declined, poverty increased, and a decade of solid progress is now threatened.

The IMF responded with unprecedented speed and scale. Financial assistance to 50 low-income countries reached $13 billion in 2020 compared to an average of $2 billion a year pre-pandemic: a more than sixfold increase. It also provided $739 million in grant-based debt service relief to 29 of its poorest and most vulnerable members.

Three-quarters of the new lending came from the Poverty Reduction and Growth Trust (PRGT)–the IMF’s vehicle for zero-interest loans to low-income countries. The lion’s share was in the form of emergency disbursements with limited conditionality focused on ensuring transparent use of the resources to address pandemic-related needs.

As they entered the pandemic with limited financial means, IMF assistance was crucial for many low-income countries to support lives and livelihoods.

Far-reaching reforms

Looking ahead, low-income countries will continue to require exceptional levels of external financial support as they recover from the pandemic, and boost investment to build more resilient and inclusive economies.

Against this backdrop, the IMF has approved a package of far-reaching reforms to the PRGT to allow it to better respond to the financing needs of low-income countries over the next few years. These include:

- Increased access to concessional financing for all low-income countries. Limits on normal access to PRGT resources have been raised by 45 percent.

- Uncapped access to concessional financing for the poorest countries. Access to concessional financing will no longer be subject to maximum levels for poorer countries with strong economic programs that meet the criteria for obtaining above-normal access levels.

- Retention of zero interest rates for all PRGT facilities. Interest rates on all PRGT loans, reviewed every two years, will be kept at zero until July 2023.

Must Read: Budget airline Ryanair posts 273 million euro loss as Covid continues to wreak havoc

- Reinforced safeguards to protect low-income countries from over-indebtedness. High borrowing levels, even on concessional terms, can push countries into unsustainable debt positions; IMF program design will pay added attention to the debt levels of countries at risk.

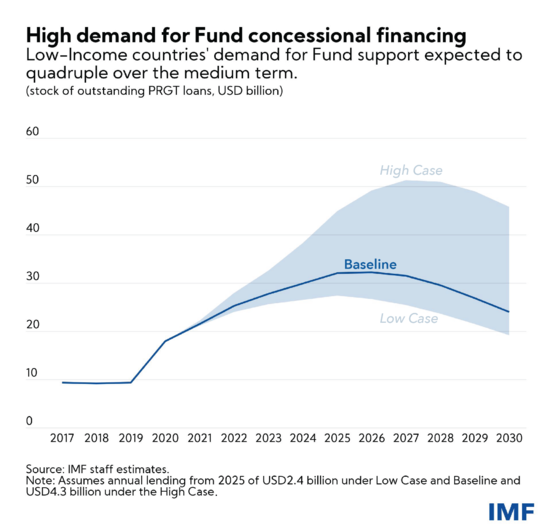

With a challenging road to recovery ahead, we project that demand for IMF support will remain elevated. Total IMF lending to low-income countries is projected to reach around $48 billion during the pandemic and its immediate aftermath. PRGT credit outstanding could peak at $32 billion in 2025-26 (chart, black line). However, there are significant uncertainties around the timing and strength of economic recovery, and the possible demand for Fund concessional support (blue shaded area).

But IMF loans will only meet a fraction of the external financing needs of low-income countries. Bilateral donors and multilateral development agencies must also step up to play their part, both through bilateral aid, and support for the IMF’s fund-raising efforts.

Moreover, if low-income countries are to maintain sustainable levels of debt, much of that financing will have to come through grants and highly concessional lending.

A two-stage funding strategy

Alongside the greater access to financing, the IMF has also approved a two-stage funding strategy to cover the cost of pandemic-related lending, and ensure the financial sustainability of its concessional support.

In the first stage, the Fund aims to mobilize a further $18 billion in PRGT loan resources and $3.3 billion in new bilateral contributions for subsidy resources to allow continued lending through the PRGT at zero interest rates. Donors will be offered various, flexible mechanisms for providing subsidy resources. This will be complemented by use of IMF internal resources of about $0.7 billion.

In the second stage of the strategy, in 2024/25—by which time current economic uncertainties are expected to have receded—the IMF will decide on the size of the PRGT and associated funding mechanisms for the long term. Use of existing and new SDRs is expected to facilitate the funding effort.

The IMF continues to step up its response to the unprecedented and persistent needs of low-income countries. The result is greater access to financing and a long-term vision for its concessional lending. It has also opened the door for donors to play their part. The sums required may sound large, but the cost of doing nothing—paid with human lives and livelihoods—will be far larger.