Stocks Set for Losses as Economy, War Fears Deepen

Asian markets are poised for losses on Monday as fears of a deeper economic slowdown unnerve traders also bracing for more volatility from rising tensions in the Middle East.

US futures dropped in early trading amid reports Iran may strike Israel to avenge assassinations of Hezbollah and Hamas officials. Saudi Arabian and Israeli stocks slumped more than 2% on Sunday, outpacing Friday’s losses on Wall Street spurred by economic worries. Equity futures indicate Australian, Japanese and Hong Kong shares are set to drop. Oil edged higher.

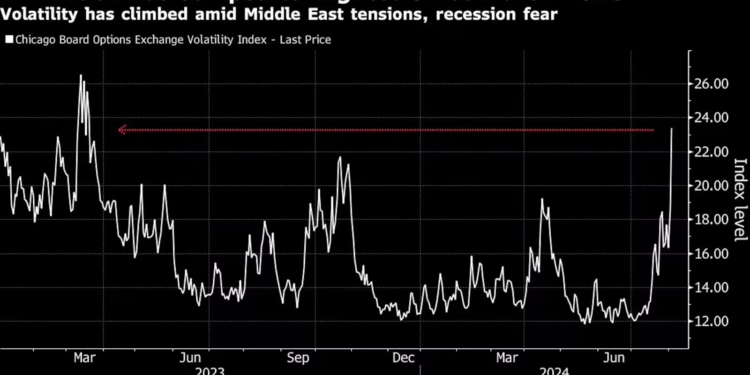

A worsening conflict in the Middle East is adding more tumult to markets as investors brace for a turbulent second half of the year. A gauge of bond market volatility has climbed, while the VIX Index – Wall Street’s fear gauge – jumped to the highest in almost 18 months after a weak US jobs report ratcheted fears of a recession, as focus increases on an already chaotic US election race.

“In the next few months global and Australian shares look vulnerable to further falls, suggesting that it’s too early to buy the dip,” said Shane Oliver, chief economist and head of investment strategy at AMP Ltd. in Sydney. “A correction is underway.”

US nonfarm payrolls rose by 114,000 in July — one of the weakest prints since the pandemic — and job growth was revised lower in the prior two months. The jobless rate unexpectedly climbed for a fourth month to 4.3%, above the Federal Reserve’s year-end forecast, triggering a closely watched recession indicator.

The S&P 500 saw its worst reaction to jobs data in almost two years, dropping 1.8% on Friday. Intel Corp. plunged 26% on a grim growth forecast, adding to a string of poor tech earnings that have sent the Nasdaq 100 down over 10% from its peak to enter a correction. Berkshire Hathaway Inc. disclosed at the weekend it slashed its stake in Apple Inc. by almost half as part of a massive second quarter selling spree.

“It’s going to be immediately seen as a negative,” said Mark Lehmann, chief executive officer at Citizens JMP Securities. “Apple is the number one player in the global consumer space and that’s the statement about the global consumer.”

Meantime, US Treasuries climbed Friday, with policy sensitive two-year yields falling to the lowest since May 2023 as worries mount the Fed’s decision to hold rates at a two-decade high is risking a deeper economic slowdown. Traders are projecting the Fed will cut rates by more than a full percentage point in 2024, with an increased chance of an outsized 50-basis point cut in September, according to data compiled by Bloomberg.

“With the unemployment rate above and core PCE inflation now below the Fed’s year-end forecasts, we believe that the balance of risks favors more aggressive action by the Fed,” said Brian Rose, a senior US economist at UBS Group AG’s wealth management unit. “We are changing our base case to rate cuts of 50 basis points in September and 25 basis points each in November and December” after previously just seeing half that amount by year-end, he wrote in a note to clients.

In Asia, traders will soon focus on the private Caixin China services and composite activity data for a further gauge on the health of the world’s second largest economy after manufacturing PMI contracted unexpectedly for the first time in nine months. The data comes as Chinese officials made clear in July that there would be limited aid to spur domestic consumption.

Elsewhere this week, inflation data in Thailand and Chile are due while Mexico and Peru will hold policy decisions as debate rages on the outlook for emerging market dollar and local currency bonds. The Reserve Bank of Australia’s policy meeting will be parsed to confirm bets of easing by year-end, while US economic activity and credit data and speeches from regional Fed bank presidents will be closely watched.

“Better data this week could provide some confidence to a bond market that is grossly overbought and offer reassurances to equity and credit,” Chris Weston, head of research at Pepperstone Group wrote in a note to clients.

“Conversely, if the data continues to weaken and central banks don’t meet the market pricing in their narrative, one thing seems clear: buying the dip in risk may not be as effective this time around, while short sellers will have a far more prosperous hunting ground,” he said.

Some of the main moves in markets:

Stocks

- Hang Seng futures fell 0.4% as of 7:18 a.m. Tokyo time

- S&P/ASX 200 futures fell 1.5%

- Nikkei 225 futures fell 3.1%

- S&P 500 futures fell 0.8%

Currencies

- The Bloomberg Dollar index was little changed

- The euro was little changed at $1.0921

- The Japanese yen was little changed at 146.44 per dollar

- The offshore yuan was little changed at 7.1630 per dollar

- The Australian dollar was little changed at $0.6514

Cryptocurrencies

- Bitcoin fell 0.8% to $58,672.16

- Ether fell 0.6% to $2,735.23

Bonds

- The yield on 10-year Treasuries declined 19 basis points to 3.79% on Friday

Commodities

- Spot gold fell 0.1% to $2,443.24 an ounce

- West Texas Intermediate crude rose 0.4% to $73.78 a barrel