Bright Simons slams COCOBOD’s $3bn ‘pipe-dream’ plan to refinance cocoa bills

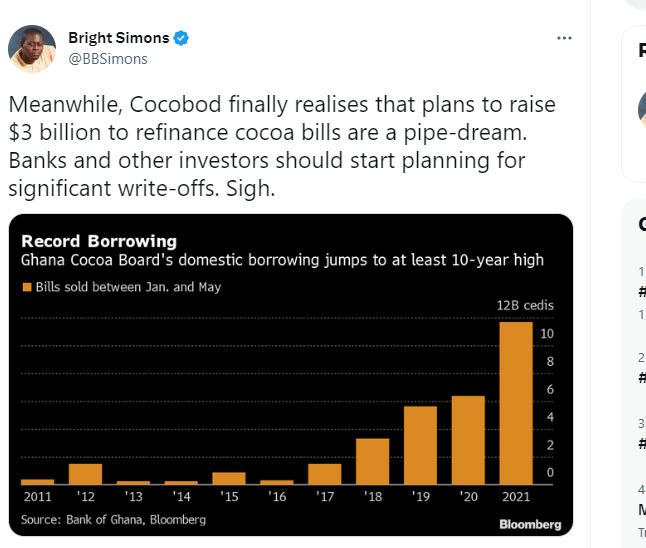

Ghana’s Cocoa Board (COCOBOD) plans to raise $3bn to refinance its cocoa purchases have been dismissed as a “pipe-dream” by Bright Simons, Vice President of IMANI Africa.

He suggests that banks and other investors should prepare for significant write-offs. COCOBOD’s borrowing cost has also reportedly jumped to at least a 10-year high, with yields surging to over 10%.

The Bank of Ghana, COCOBOD and commercial banks have agreed to allow banks to use COCOBOD’s deposits to pay retail customers who may not want a rollover of their cocoa bills.

This follows initial direction from the Bank of Ghana for banks not to pay customers their maturing cocoa bills investments, due to cash flow challenges facing COCOBOD.

The Central Bank has stated that it expects these short-term cash flow challenges to be resolved soon, allowing COCOBOD to meet its obligations to investors.

The outlook for the 2023 crop season is said to be positive and cocoa purchasing is ahead of last year.