T-Bill Auction Undersubscribed as Government Raises GHS 6.24bn Against GHS 8.28bn Target

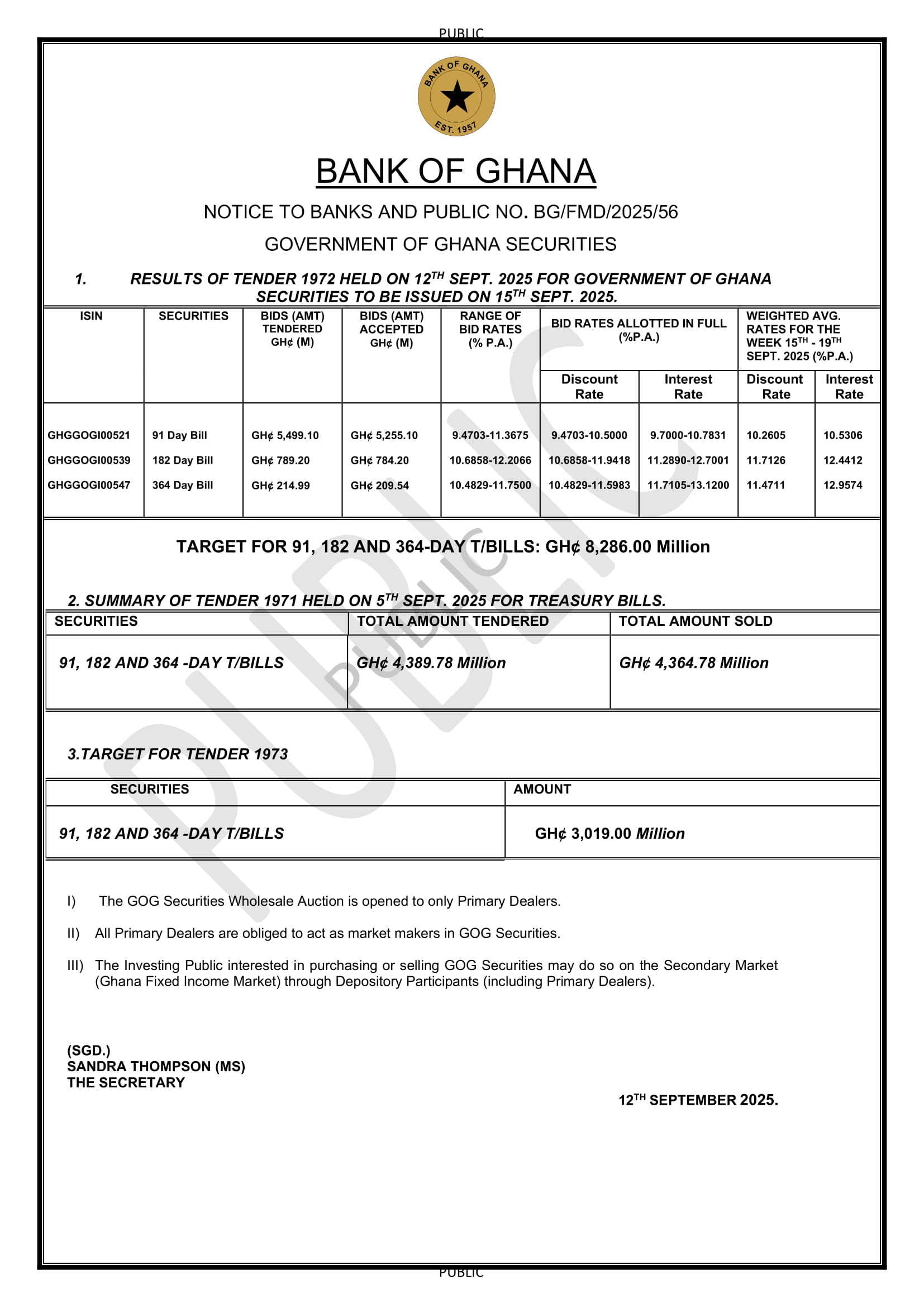

Government has raised GHS 6.24 billion in its latest Treasury bills (T-bills) auction, falling short of the GHS 8.28 billion target by GHS 2.03 billion.

The undersubscription contrasts with last week’s oversubscription, reflecting a shift in investor appetite for short-term government securities.

Per auction results released by the Bank of Ghana (BoG), total bids submitted amounted to GHS 6.50 billion, with the government accepting GHS 6.24 billion.

Yields on the short-term debt instruments registered mixed movements, as the 91-day bill cleared at 10.53 percent, marginally up from 10.42 percent the previous week.

The 182-day instrument edged higher to 12.44 percent from 12.41 percent, while the 364-day bill declined slightly to 12.95 percent from 12.97 percent.

The next issuance, scheduled for September 19, 2025, seeks to raise GHS 3.01 billion. Analysts note that the government continues to rely heavily on the T-bill market to refinance maturing obligations and ease liquidity constraints.