RelatedPosts

T-Bill Oversubscription Continues as Yields Fall to 17.2% on Average

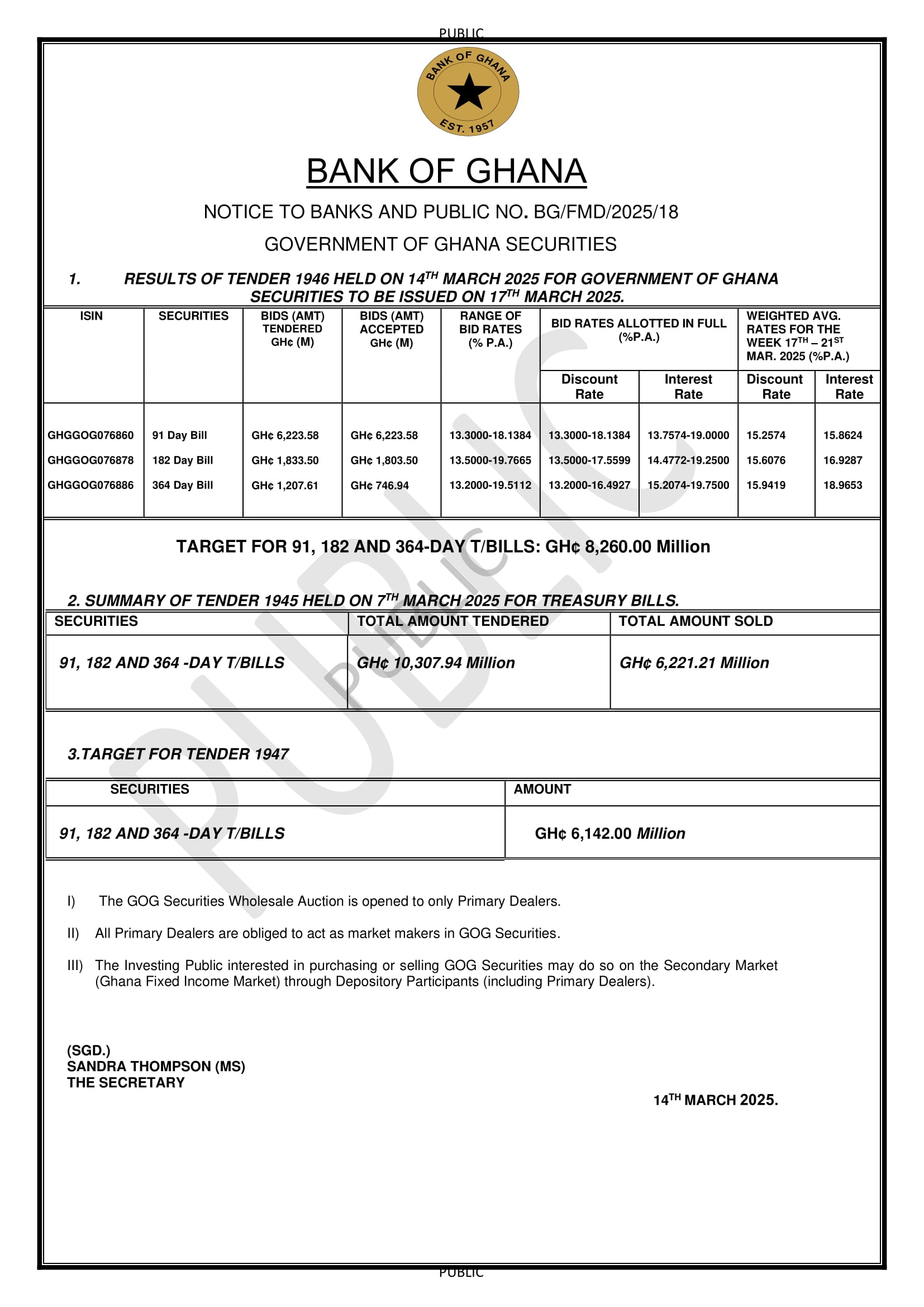

Investor demand for Ghana’s short-term government securities remained resilient in the latest Treasury bill auction on March 14, with bids totaling GHS 9.26 billion—exceeding the government’s GHS 8.26 billion target by 10.7%.

Despite the oversubscription, yields continued to decline across all maturities. The government accepted GHS 8.77 billion in bids, surpassing its target by GHS 512 million while rejecting GHS 490 million worth of offers.

The 91-day bill saw the strongest demand, attracting bids of GHS 6.22 billion, all of which were accepted. The 182-day and 364-day bills recorded bids of GHS 1.83 billion and GHS 1.20 billion, with accepted amounts of GHS 1.80 billion and GHS 746 million, respectively.

Yields on the 91-day and 182-day instruments fell to 15.86% and 16.92%, down 185 and 204 basis points from the previous auction. The 364-day bill also declined, settling at 18.96%, a 102-basis-point drop.

The auction results come as the government plans to raise an additional GHS 6.14 billion in short-term debt at its next sale on March 21.