T-Bill Undersubscribed as Gov’t Manages to Mobilize GHS 2.8bn

Short-term debt instruments issued by Government witnessed a significant undersubscription in the latest auction, as investor participation weakened compared to the previous week.

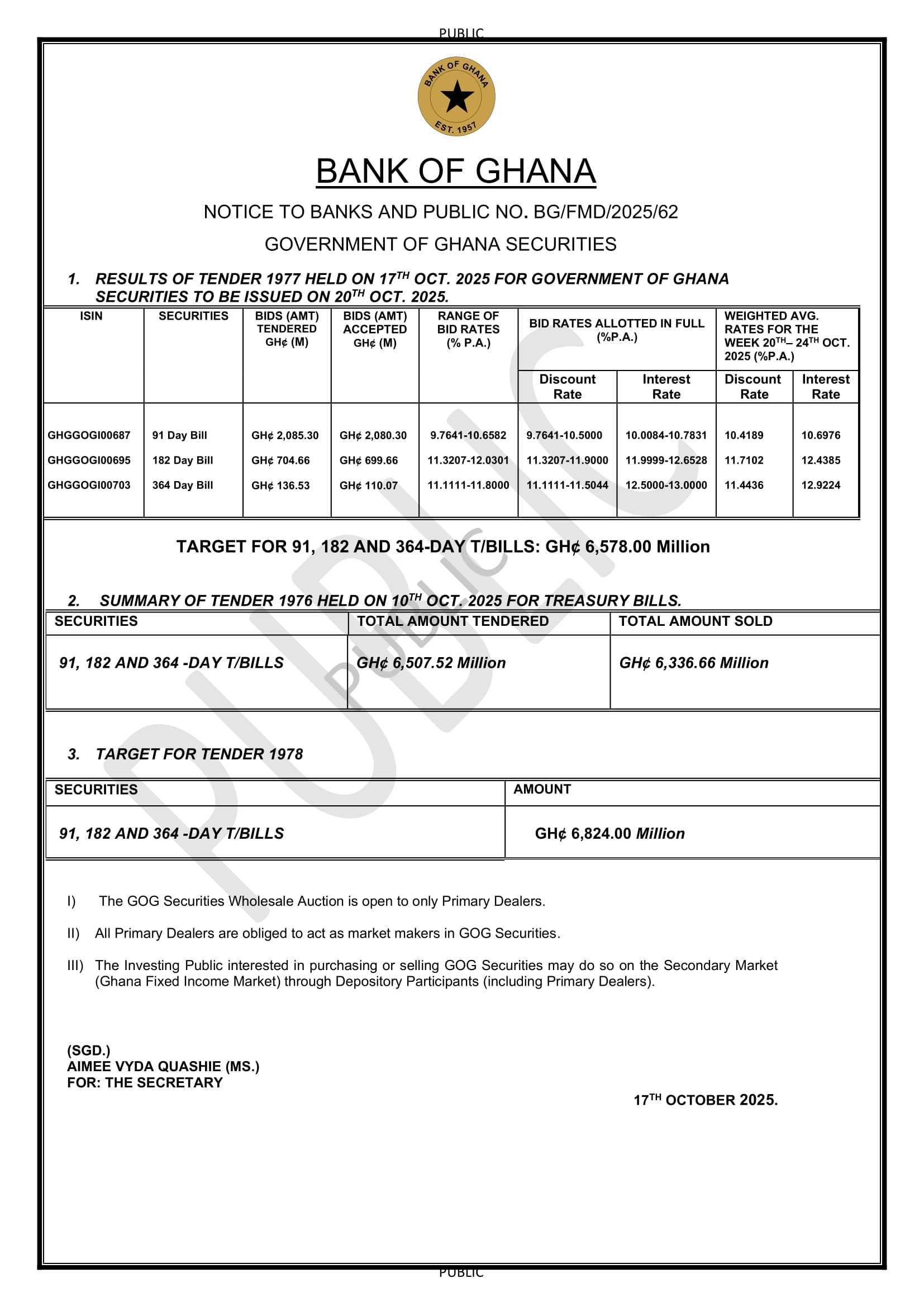

Government successfully raised GHS 2.88 billion against a target of GHS 6.57 billion, leaving a shortfall of GHS 3.68 billion and marking an undersubscription of over 55%. The latest outcome contrasts sharply with the oversubscription recorded in the preceding auction.

Yields on the short-term debt instruments, however, continued on an upward trajectory. The 91-day bill cleared at 10.69%, up from 10.53% at the previous auction, while the 182-day and 364-day bills cleared at 12.43% and 12.92% respectively, compared to 12.30% and 12.86% earlier.

Market analysts note that the undersubscription is unlikely to be driven by unattractive returns, given that inflation has eased to 9.4%, well below the average interest rate of 12.01% across the three tenors.

In this week’s upcoming auction, Government will be seeking to raise GHS 6.82 billion across the 91-, 182-, and 364-day maturities. Market watchers will be monitoring closely to determine whether investor appetite will recover or if the undersubscription trend will persist.