GRA Assesses Bills Micro-Credit Founder’s Personal Income Tax Liability at GHS 30 Million

Ghanaian tax authorities have launched an investigation into the personal finances of Richard Nii Armah Quaye, the founder of Bills Micro-Credit, assessing his outstanding income tax liabilities at no less than GH₵30 million.

The Ghana Revenue Authority (GRA) has indicated that this is an interim figure, with the potential for further revisions as investigations progress. The scrutiny follows the settlement of an import duty of GH₵11.4 million on a luxury vehicle acquired by Mr. Quaye.

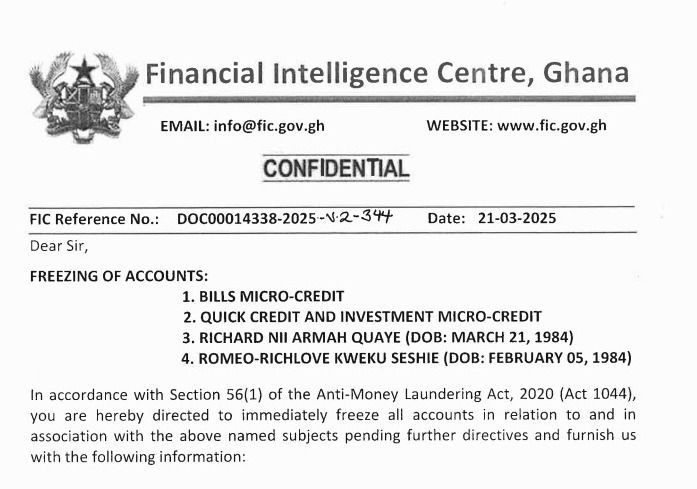

In a parallel development, the Financial Intelligence Centre (FIC) has moved to freeze all corporate accounts of Bills Micro-Credit and Quick Credit and Investment Micro-Credit, as well as the personal accounts of Mr. Quaye and the CEO of Bills Micro-Credit, Romeo-Richlove Kweku Seshie.

The action, taken under Section 56(1) of Ghana’s Anti-Money Laundering Act, 2020 (Act 1044), was implemented on March 21, 2025, and remains in force pending further directives.

Regulators initiated the tax review as part of routine compliance procedures, seeking to verify the entrepreneur’s adherence to fiscal obligations. However, the timing of the probe has drawn attention, coming shortly after Mr. Quaye’s highly publicized 40th birthday celebration, which attracted widespread social media coverage. It remains unclear whether the investigation was prompted by the event or had already been in motion.

Amid mounting speculation over the company’s financial entanglements, Bills Micro-Credit Limited has issued a statement distancing its operations from Mr. Quaye’s personal finances. The firm asserted that it remains an independent legal entity and does not finance the chairman’s private expenditures or events.

The company also clarified that Mr. Quaye, while its founder, chairman, and majority shareholder, does not serve as its chief executive.