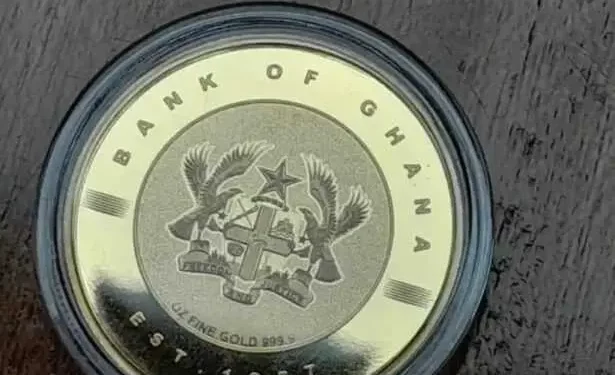

The Average Ghanaian Needs GHS 25,102 to Own a Bank of Ghana Gold Coin

The average Ghanaian needs an average amount of GHS 25,102 to enable him or her own a single Bank of Ghana Gold Coin.

As of Monday, January 20, 2025, the Bank of Ghana Gold coins available in three denominations—0.25oz, 0.50oz, and 1oz— were priced at GHS 11,248, GHS 21,623, and GHS 42,435, respectively, based on an exchange rate of $1 to GHS 14.95.

Averagely, the price of a single gold coin amounts to GHS 25,102.

The price of gold on the London Bullion Market Association (LBMA) as of Monday, January 20, 2025, stood at $2,715 per ounce.

The prices of the gold coins are significantly influenced by the performance of gold on the world market and the Cedi/dollar exchange rate.

According to the Bank of Ghana, the Ghana Gold Coin (GGC) initiative forms part of the BoG’s domestic gold programme aimed at absorbing excess market liquidity and strengthening the Ghanaian Cedi amid ongoing economic pressures.

But most importantly, the BoG notes that it is offer the Ghanaian public an alternative investment channel.

But with such a huge amount of cedis needed to purchase a single gold coin, it will be a wonder to see the average Ghanaian want to buy the gold coin, talk less of making it an alternative investment channel to the other forms of investments in the country.