The odds of $100 oil are rising as supply shocks convulse the market

When oil jumped above $90 a barrel just days ago, military tensions between Israel and Iran were the immediate trigger. But the rally’s foundations went deeper — to global supply shocks that are intensifying fears of a commodity-driven inflation resurgence.

A recent move by Mexico to slash its crude exports is compounding a global squeeze, prompting refiners in the US — the world’s biggest oil producer — to consume more domestic barrels. American sanctions have stranded Russian cargoes at sea, with Venezuelan supply a potential next target. Houthi rebel attacks on tankers in the Red Sea have delayed crude shipments. And despite the turmoil, OPEC and its allies are sticking with their production cuts.

It all adds up to a magnitude of supply disruption that has taken traders by surprise. The crunch is turbocharging an oil rally ahead of the US summer driving season, threatening to push Brent crude, the global benchmark, to $100 for the first time in almost two years. That’s amplifying the inflation concerns that are clouding US President Joe Biden’s reelection chances and complicating central banks’ rate-cut deliberations.

For oil, “the bigger driver right now is on the supply side,” Amrita Sen, founder and director of research at Energy Aspects Ltd., said in a Bloomberg Television interview. “You have seen quite a few pockets of supply weakness, and demand overall on a global basis is healthy.”

Oil shipments from Mexico, a major supplier in the Americas, slid 35% last month to their lowest since 2019 as President Andres Manuel Lopez Obrador tries to make good on promises to wean the country off costly fuel imports. The country’s exports of so-called sour crude — the heavy, dense kind that many refineries are designed to process — now stand to shrink even further as state-controlled oil company Pemex has canceled some supply contracts to foreign refiners, Bloomberg News reported last week.

That decision has roiled oil markets around the world. Mars Blend, a medium-density sour crude from the US Gulf Coast, has in recent days risen to a multi-year premium over lighter West Texas Intermediate, the national benchmark. Mars usually trades at a discount to WTI. Brent crude hit $90 a barrel on Thursday, the highest since October, and extended gains on Friday. JPMorgan Chase & Co. has said it could hit $100 by August or September.

Canadian Cold Lake oil priced at the Gulf Coast traded at the narrowest discount to WTI in almost a year. Key indicators for Middle Eastern medium-sour crude, such as Oman and Dubai contracts, are rallying too.

Before Mexico’s move, there was a sequence of supply disruptions both large and small. In January, a deep freeze ate away at crude output and inventories in the US at a time when they would normally grow, keeping stockpiles below seasonal averages through late March.

Mexico, the US, Qatar and Iraq cut their combined oil flows by more than 1 million barrels a day in March, tanker tracking data compiled by Bloomberg show. Baghdad has pledged to limit output to make up for non-compliance with prior pledges to the Organization of the Petroleum Exporting Countries and its allies, known as OPEC+.

Adding to the tightness, OPEC member the United Arab Emirates curbed shipments of Upper Zakum, a medium-sour oil, by 41% in March compared with last year’s average, according to data from maritime intelligence firm Kpler. The state oil company is diverting more supplies of that crude to its own refinery, traders said. Though the cuts were expected and Abu Dhabi National Oil Co. is offering buyers another type of crude as a substitute, the decline in Upper Zakum exports is contributing to higher regional prices amid the broader OPEC+ curtailment.

Crude markets in Europe, meanwhile, were pressured higher by the Houthi attacks in the Red Sea, which sent millions of barrels of crude on a detour around Africa, delaying some supplies for weeks. Disruptions to a key North Sea pipeline, unrest in Libya and a damaged pipe in South Sudan also contributed to the rally, while US sanctions have deprived Russia of tankers that previously transported its oil to buyers including India.

The supply pinch could become even more acute in the weeks ahead. With President Nicolas Maduro showing no sign of heeding promises to move toward free and fair elections, the Biden administration could reimpose sanctions this month.

The market for heavier, dirtier oil “has been rangebound to bearish for some time now, but this tightness in sour markets and the outlook for the summer driving season in the US suggest the market is turning a corner,” said Samantha Hartke, an analyst with analytics firm Sparta Commodities.

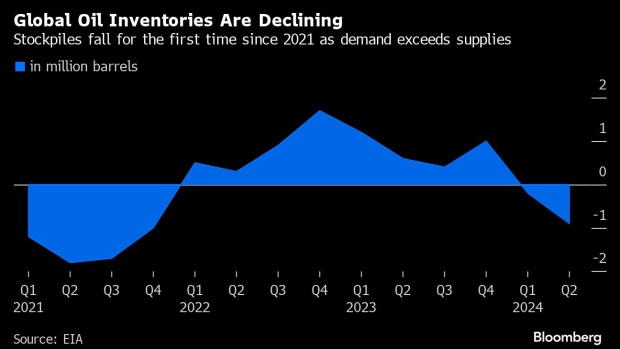

It’s a stark contrast from just a few months ago, when oil plunged to multi-month lows as US production climbed and Russian seaborne crude exports ratcheted higher despite sanctions, which have since been expanded. The US Energy Information Administration, after forecasting global inventories to remain unchanged this quarter, now predicts they’ll fall by 900,000 barrels a day. That’s the equivalent to the production from Oman.

The supply squeeze comes as demand is ramping up. US refiners are preparing to boost fuel production for the summer, when millions of Americans take to the roads and gasoline consumption peaks. Gasoline stockpiles on the populous East Coast are tightening and manufacturing activity in the US and China is also signaling a boost in fuel use. In Asia, refining margins are around 50% higher than the five-year seasonal average, suggesting healthy demand.

Crude’s rally has snarled the Biden administration’s plans to refill emergency US oil reserves, which reached a 40-year low following an unprecedented drawdown after Russia’s invasion of Ukraine. It’s also a political risk for Biden as prices for food and energy remain stubbornly high. Oil’s advance threatens to push retail gasoline, now near a daily national average of $3.60 a gallon, toward $4, a key psychological level. That’s contributing to concern that commodities will reverse the recent slowdown in consumer price gains.

Oil prices are now boosting US inflation after subtracting from it at the end of last year. That may be evident again in the March consumer price index due Wednesday, as the overall CPI is seen accelerating on an annual basis, while the core measure that excludes food and energy is expected to tick down. A Bloomberg index of key commodities has reached the highest level since November.

The crude price surge could ultimately force OPEC+ to dial back some production cuts, said Vikas Dwivedi, a global oil and gas strategist for Macquarie Group. And oil substantially above $90 can lead to global demand destruction and ultimately lower prices, according to JPMorgan. But so far, there’s little sign of that happening yet.

“It is a market on firm fundamental footing, no question. I think $100 oil is entirely real — it just requires a little more risk pricing on the true geopolitical risk,” Bob McNally, founder of consultant Rapidan Energy Group and a former White House adviser, said in a Bloomberg Television interview.