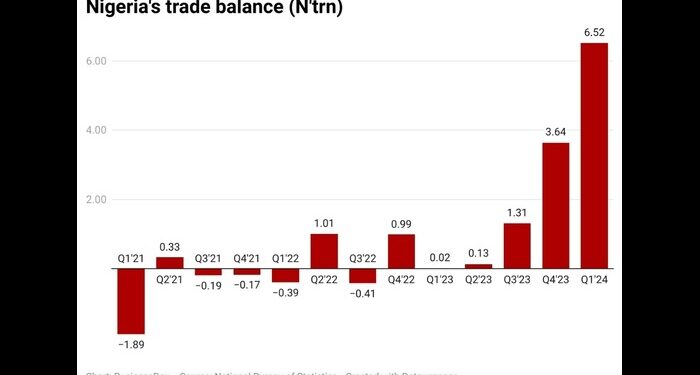

Trade surplus hits 14-yr high as weak naira lifts exports

Nigeria’s trade surplus, the difference between exports and imports, rose to N6.52 trillion in the first quarter of 2024, according to the latest foreign trade statistics report released by the National Bureau of Statistics (NBS) on Sunday.

A trade surplus occurs when a country’s exports exceed its imports.

Total merchandise trade in Africa’s most populous nation stood at N31.8 trillion in Q1, an increase of 46.3 percent compared to the preceding quarter and a 145.6 percent jump compared to a year ago.

“Exports accounted for 60.3 percent of total trade in the reviewed quarter with a value of N19.2 trillion, showing an increase of 51 percent compared to Q4 (N12.7 trillion) and 195.5 percent over the value recorded in Q1 2023 (N6.48 trillion),” the NBS report said.

Analysts attributed the surge in exports to the exchange rate depreciation caused by the foreign exchange reform implemented last June.

“The increased trade surplus can be linked to the devaluation effect, with the country getting more naira from export proceeds per dollar,” Israel Odubola, a Lagos-based research economist, said.

He said having a positive trade surplus is favourable to the current account as it helps to reduce external pressure. “A trade surplus is quite significant in current account composition,” Odubola said.

Abiodun Keripe, managing director at Afrinvest Consulting, also attributed the surge in trade surplus to the weaker currency.

“Exports would improve significantly because the naira is weaker which would attract more dollar inflows whether in the form of trade or any other form,” Keripe said.

The naira suffered a near 30 percent devaluation this year following a 40 percent devaluation last June. The official exchange rate increased from N463.38/$ on June 9, 2023, to N1.483.9/$ as of June 7, 2023. At the parallel market, the naira depreciated to N1,495/$ from 762/$.

Recent data from the International Monetary Fund highlighted that Nigeria’s current account balance, a measure of its net trade in goods, services, and transfers with the rest of the world, rose to $1.21 billion last year from $1.02 billion in 2022.

“A growing current account surplus can be a sign of economic strength, indicating that the country’s industries are competitive internationally and that its exports are in demand,” Ibrahim Bakare, a professor of Economics said.

“It may also lead to an appreciation of the country’s currency, as increased demand for its goods and services boosts the value of its currency relative to others,” he added.

Exports in Q1 was dominated by crude oil valued at N15.4 trillion representing 80.8 percent of total exports while the value of non-crude oil exports stood at N3.68 trillion, accounting for 19.20 percent of total exports; of which non-oil products contributed N1.78 trillion or 9.28 percent of total exports.

On the other hand, the share of total imports accounted for 39.7 percent of total trade in Q1 with the value of imports amounting to N12.6 trillion, an increase of 39.6 percent over Q4 (N9.05 trillion) and 95.5 percent compared to Q1 2023 (N6.47 trillion).

China ranked highest among the top trading partners on the import side in Q1, followed by India, the United States of America, Belgium, and The Netherlands.

The most traded commodities were Motor spirit ordinary, Gas oil, Durum wheat (Not in seeds), Cane sugar meant for sugar refinery, and Other Liquefied petroleum gases and other gaseous hydrocarbons.