Treasury Bill Auction Faces Second Consecutive Undersubscription Amid Investor Caution

Ghana’s auction of short-term debt instruments recorded a second consecutive undersubscription last week, with bids falling short by 27.16%, equivalent to GHS 1.53 billion, underscoring cautious investor sentiment in the fixed-income market.

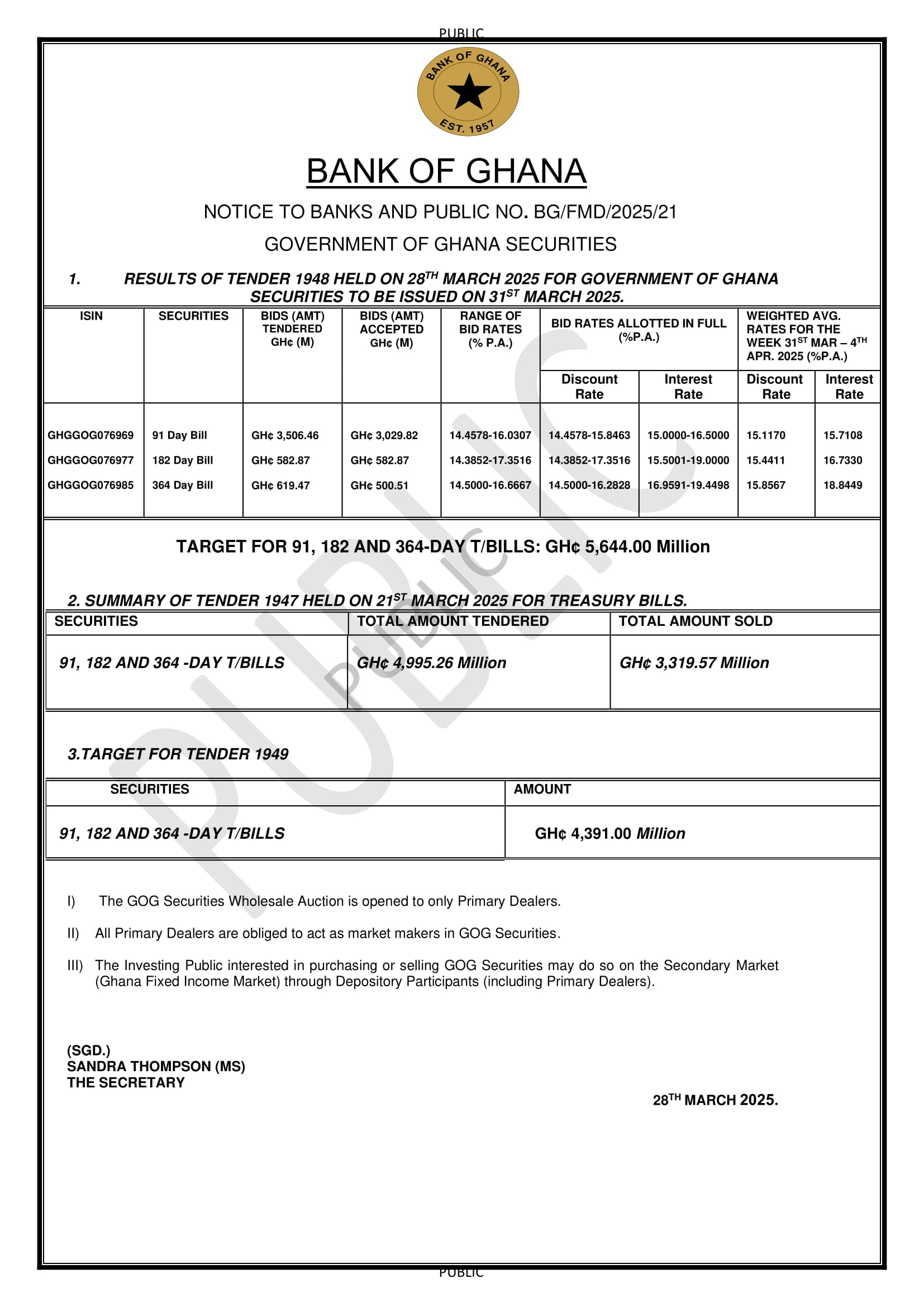

At last Friday’s auction, the government received total bids worth GHS 4.70 billion against a target of GHS 5.64 billion.

Of this, GHS 4.11 billion was accepted, reflecting a measured approach to debt issuance amid changing market dynamics.

The 91-day bill saw the highest demand, attracting GHS 3.50 billion in bids, of which GHS 3.02 billion was accepted.

The 182-day and 364-day bills recorded bids of GHS 582 million and GHS 619 million, with the government accepting GHS 582 million and GHS 500 million, respectively.

Yields on the 91-day bill declined by 2 basis points to 15.71%, while the 364-day instrument held steady at 18.84%.

The yield on the 182-day bill remained unchanged from the previous auction at 16.73%.

The results come as the government prepares to raise an additional GHS 4.39 billion at its next short-term debt sale scheduled for April 4, 2025.

The undersubscription signals investor caution in the fixed-income market.