Treasury Bills: Gov’t short-term borrowing declines to GHS 9.1bn in July

Government borrowed ¢9.14 billion through treasury bills in July 2023, marking a 29.11% decrease compared to the previous month, according to official reports.

The auctions recorded bid/cover, target coverage, and maturity coverage ratios of 1.01, 1.10, and 0.95, respectively.

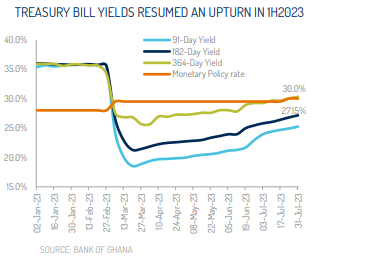

On a monthly basis, yields for the 91-day and 182-day treasury bills experienced notable surges, reaching 25.24% (129 basis points) and 27.15% (135bps), while the 364-day bill closed at 30.31% (105bps).

Analysts predict further yield increases in August 2023 as investors factor in near-term inflation risks, particularly due to the government’s reliance on money market funds.

With limited domestic borrowing instruments available to the authorities amidst conditional inflows from IMF-related sources, treasury bills remain the primary avenue for government borrowing.

Consequently, upward pressure on yields is expected to persist in the near term, as affirmed by a Senior Economic Analyst.

However, the government’s recent treasury bills auction in the first week of August fell slightly short of the target, securing ¢2.179 billion against a target of ¢2.261 billion, representing a deficit of 3.6%.

The majority of bids originated from the 91-day bill, with approximately ¢1.384 billion tendered, all of which were accepted by the Treasury.

As investors weigh the implications of inflation risk and the government’s borrowing strategy, the treasury bills market is likely to face continued scrutiny, influencing the yield trajectory in the coming months.