The Trades Union Congress (TUC) has given government one-week ultimatum to announce the exemption of pension funds from the Domestic Debt Exchange Programme.

According to the Union, failure to meet the deadline which expires on Monday, December 19, 2022 will force workers to embark on industrial action.

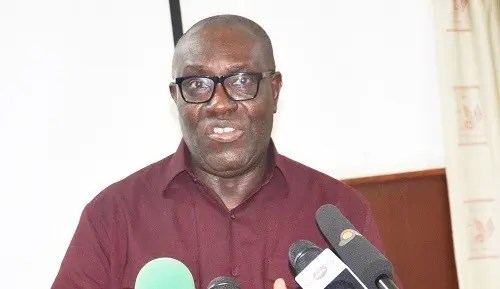

Secretary General of TUC, Dr Yaw Baah called on all workers to be ready to participate fully in any industrial action to protect pension funds.

IMF inspired policies and programmes

He warned that workers will no longer bear the consequences of any International Monetary Fund (IMF) inspired or IMF-sponsored policies and programmes.

He stated that government is responsible for all the consequences of its decisions, including the decision to seek IMF bailout.

TUC, affiliate Unions against pension funds being part of Debt Exchange

Dr Baah said TUC together with its affiliate Unions have decided that the pension funds of its members will not be part of the programme.

Negative impact of Debt Exchange on retirement income security

According to him, the decision was taken after thorough analysis of the programme which has led them to conclude that it will negatively affect the pension fund of its members and consequently, their retirement income security.

The TUC has thus demanded that government exempt all pension funds invested in government bonds from its Domestic Debt Exchange programme.

They also want government to within a week of their statement; make a public announcement to the effect that all pension funds, including Social Security and National Insurance Trust (SSNIT) Funds are exempted from the programme.

TUC opposed public sector hiring freeze

Touching on other policies the Ministry wants to implement, Dr Baah, aid, “the decision to implement a hiring freeze in the public sector is wrong.”

He said, “We had thought protecting employment would have been at the heart of the recovery process. Employment freeze in the public sector will be adding to the pain of Ghanaians, especially young graduates struggling to secure employment.”

Tax measures will hurt poor people

On taxation, the TUC is of the view that the decision to raise Value Added Tax (VAT) rate will by 2.5 percentage points; the maximum personal income tax margin from 30 to 355; and the removal of the Electronic Transactions Levy (E-Levy) threshold, will hurt poor people and workers on fixed and low incomes.

Downsizing of government

TUC therefore reiterated its demand for the immediate and radical downsizing of government, including a substantial reduction in the number of Ministries and ministerial portfolios.

Such a measure, the Union believes, “will assure the Good People of Ghana that government is doing its part to reduce expenditures.”

They further called on government to “substantially increase salaries for workers, especially those on the Single Spine Salary Structure,” has complete erosion of the purchasing power of workers, especially those in the public service, due to the surge in inflation.

They also called for salaries of public sector workers on the single spine structure to match salaries on the structures being implemented by the SOEs for their staff.

The COVID-19 pandemic, rising global food prices, rising crude oil & energy prices; and the Russia-Ukraine war adversely affected Ghana’s macroeconomy, with spillovers to the financial sector.

The combination of adverse external shocks had exposed Ghana to a surge in inflation, a large exchange rate depreciation and stress on the financing of the budget, which taken together have put our public debt on an unsustainable path.

Debt servicing is now absorbing more than half of total government revenues and almost 70% of tax revenues, while total public debt stock, including that of State-Owned Enterprises and all, exceeds 100% of GDP.

Debt Sustainability Analysis (DSA) had demonstrated that Ghana’s public debt was unsustainable, and that the government may not be able to fully service its debt down the road if no action is taken.

The DSA had demonstrated that Ghana is faced with a significant financing gap over the coming years revealing that public debt is unsustainable.

To address the ongoing economic crisis, the government had already requested financial support from the IMF.

GH₵137bn

In the Debt Exchange programme, government is targeting GH₵137 billion in domestic notes and bonds from domestic debt holders.

4 New Ghana bonds

Domestic debt operation involves an exchange for new Ghana bonds with a coupon that steps up to 10% as soon as 2025 (with a first interest payment in 2024) and longer average maturity.

Maturing dates for the new bonds

Existing domestic bonds as of December 1 2022 will be exchanged for a set of four new bonds maturing in 2027, 2029, 2032 and 2037.

Predetermined allocation ratios

Predetermined allocation ratios are 17% for the short bonds, 17% for the intermediate bond, 25% for the medium-term bond and 41% for the long-term bond.

Annual coupon rates

The annual coupon rates on all of these new bonds will be set at 0% in 2023, 5% in 2024 and 10% from 2025 until maturity. Coupon payments will be semi-annual.

Eligible holders, who deliver valid offers at or prior to the expiration date that are accepted by the country, will receive at the settlement date in exchange for their eligible bonds accepted, the same aggregate principal amount distributed across new bonds due dates.

Offers end on December 19

Offers may only be submitted starting from December 5, 2022, and ending at 4:00 p.m. (Greenwich Mean Time (GMT)) on December 19, 2022.

Sole discretion to extend expiration date

However, government may at its sole discretion extend the expiration date, including for one or more series of eligible bonds.

Only registered holders eligible

The invitation is available only to registered holders of eligible bonds that are not individual investors or that are otherwise authorised by the Government of Ghana, in its sole discretion, to participate in the Invitation.

Government said eligible holders tendering their eligible bonds pursuant to the invitation will receive new bonds of the country on the terms and subject to the conditions described in the Exchange Memorandum.

All offers irrevocable

All offers to exchange eligible bonds made by eligible holders are irrevocable and by tendering their eligible bonds, eligible holders represented and warrant.

Eligible bonds

Such eligible bonds constitute all the eligible bonds owned by them and consent to the blocking by the Central Securities Depository of any attempt to transfer them prior to the settlement date or the termination of the invitation.