U.S. Shale production is set for a rapid decline

I have argued in several Oilprice articles, and most recently in February 2023, that the era of increasing output from shale wells did not have much more room to run absent a price signal that caused a huge increase in drilling. A price signal similar to the one the market received with the onset of the Ukraine invasion, that added 153 rigs in U.S. shale plays from January to June of 2022. Instead, as the market adapted to the loss of Russian oil and gas, and worries about the strength of the economy cast doubt on demand, prices began to soften throughout the rest of the year.

As we approach the midpoint of 2023, WTI prices have mostly stayed in a $70-$80 range, continuing a pattern that established itself in late Q-4, 2022. There is nothing in the next few months that will interrupt this pattern, but if we look a little farther out, in the next six to eight months, we can make a case for a transformative drop in U.S. domestic production.

Subtle changes in the U.S. E&P landscape

The chart below is a little busy, so we will spend some time decoding it. The multi-colored, vertical bars show changes in the drawdown of Drilled, but Uncompleted (DUC) wells over the last four years. Low oil prices from 2019 through December, of 2021 drove a decline in DUCs from ~4,000 to 1,446, more than 75%. During this period, oil companies desperate for revenue and needing to control costs thanks to oil prices below $70 per barrel, turned to DUCs to maintain output. Post-January 2022, higher oil and gas prices drove a rapid increase in drilling, and attenuated the trend toward DUC activation as the year wore on. From January of 2023, both DUC withdrawals and drilling have declined and shale output has essentially flatlined around 9,300 mm BOPD, according to the monthly EIA-Drilling Productivity Report. The most recent results of which are captured in the graph below, along with rig data from Baker Hughes and frac spread count data from Primary Vision.

One final point I’ll make regarding the graph above, and I will have to ask you to use your imagination as I didn’t graph this, but you will notice the slope of the decline curve for DUCs is largely a mirror image of the increase in production from January of 2021. The takeaway being that DUC withdrawal is responsible for much of the 1.7 mm BOEPD added since Jan-2021.

Drilling doesn’t begin to pick up until June 2021 and it’s not until June 2022 that the rig count-dedicated to oil, rises above 600. The rate at which I estimate is necessary to grow production beyond the natural decline rate, ~40% annually, of shale typically. I discussed this in a recent Oilprice article. Related: Warren Buffett Buys Up Even More Occidental Petroleum

“We have had about 600 oil rigs turning to the right since the middle of last year. Since June 22, we have gone from 8.7 mm to 9.4 mm BOPD in shale output, or about 700K BOPD of increase. That’s less than 58K per month of new production, meaning that about 82% of the ~14K wells drilled in 2022 were to replace legacy production. It only gets worse from here.”

What happens from here?

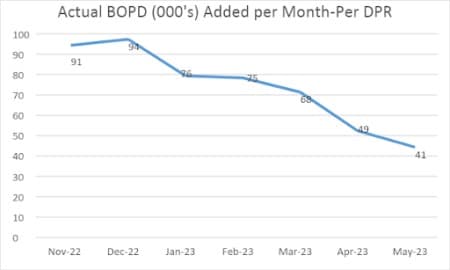

I’ll start with another graph. Beginning in January of 2023, you see a sharp decline in the rate of new oil added per month. This is consistent with the fact that the first DUCs Turned In Line-TIL’d since Jan-21, are watering out as production falls below 50 BOPD, just as the oil-rig count has dropped below 600. This means that the two drivers – DUC withdrawals and an increasing rig count – that have propelled production to post-Covid highs are in retreat, and there is only one outcome possible. Daily shale output is nearing an inflection point and may soon start a rapid decline, that will be impossible to reverse, absent a huge increase in the rate of drilling new wells that cannot be sustained in today’s market.

Your takeaway

The full effect of this decline in shale output is likely going to occur at the worst possible time if your interests coincide with low to moderate oil prices. Many large banking institutions are warning of a supply deficit later this year which will cause oil prices to spike, as noted in this OilPrice article.

Noteworthy also is the surprise factor for the markets when, and if, my projections bear out. No one is forecasting a decline in shale production at this point, making me something of a heretic. The most recent EIA – Today in Energy forecasts shale production rising to 11 mm BOPD by year-end 2024. We can’t both be right.

It’s not for me to make a determination about final outcomes. The observable trends support my thesis, and that creates an opportunity for investors looking for growth in their portfolios. As noted in the Oilprice article-Goldman Sachs: Oil Markets to Face Crisis in 2024, the energy sector is by far the cheapest of 11 market sectors tracked at a 5.7 PE. The article goes on to say-

“Indeed, the energy sector is the cheapest of all 11 U.S. market sectors, with a current PE ratio of 5.7. In comparison, the next cheapest sector is Basic Materials with a PE valuation of 11.3 while Financials is third cheapest at a PE value of 12.4. For some perspective, the S&P 500 average PE ratio currently sits at 22.2. So, we can see that oil and gas stocks remain dirt cheap even after last year’s massive runup, thanks in large part to years of underperformance.”

That should suggest possibilities in the upstream energy sector to investors willing to look past the day-to-day ups and downs currently being experienced in oil and gas prices. Scarcity exacerbates demand, which is already forecast to be strong, and should be very bullish for oil prices as we move through the year.