Ghanaian banks exhibiting poor financial soundness indicators compared to peers

Fitch Solutions is warning that Ghanaian banks are exhibiting poor financial soundness indicators compared to peers in Sub-Saharan Africa.

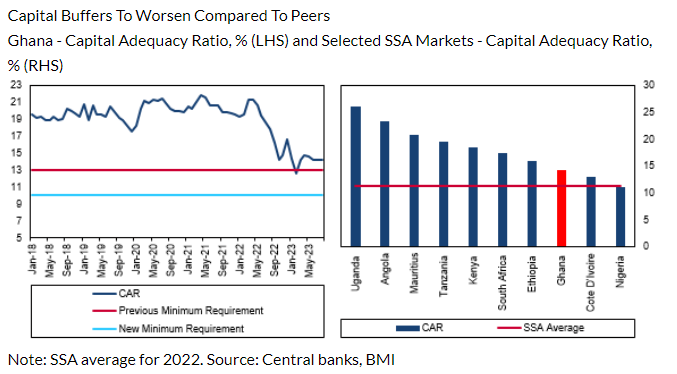

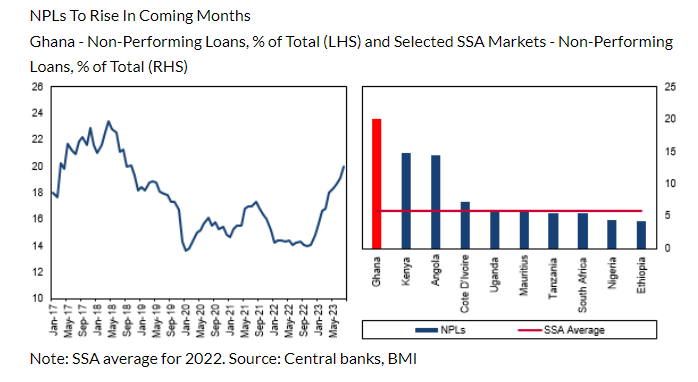

In its latest article on Ghana, it said that compared to its peers, Ghanaian banks have considerably worse loan quality, weaker capital buffers, and a much lower loan-to-deposit ratio.

“That being said, banks are continuing to report strong profits, on the back of high net interest income”, it added.

Compared to the largest Sub-Saharan Africa sectors, Ghana’s capital buffers are weak and will deteriorate further compared to its peers for two main reasons.

First, it stated that markets such as Côte d’Ivoire and Nigeria will see an improvement in their Capital Adequacy Ratio (CAR) in the coming quarters as a result of improving economic conditions and as Nigerian banks build up capital buffers using their foreign currency revaluation gains.

Second, it pointed out that whilst it expects some banking sectors in the region, such as South Africa and Kenya, to experience falling capital levels, these will be less pronounced than Ghana’s capital deterioration, which will widen the gap between the sectors’ CARs.

Despite this, the UK-based firm said it anticipates that banks will significantly bolster capital levels in 2024.

“The banking sector has seen a considerable deterioration in capital since April 2022, as a result of losses on investments, especially government securities, and increases in the risk-weighted assets of banks, from currency depreciation and credit growth. We think that banks will build up capital buffers in the coming months to account for further losses, as well as provisions for worsening loan quality”.

The sector’s capital adequacy ratio (CAR) stood at 14.2% in August 2023 for the third month while some of the largest banks in Ghana saw their CAR increase between quarter 2, 2023 and quarter 3, 2023.

Fitch Solutions also expects loan quality to deteriorate further in the coming months, although banks will try to improve their loan books.

The sector’s NPL ratio has risen sharply from 14.0% in October 2022 to 20.0% in August 2023, as an economic environment of high interest rates, inflation and weaker economic growth weighed on consumers’ ability to repay loans.

Again, rising bad debts and weak loan growth in the first half of 2024 will lead to further deterioration in loan quality.

However, it alluded that loan quality should start to improve in second half of 2024 as the economic environment improves and banks make a concerted effort to improve it by reducing exposure to certain sectors.

“The sector’s NPL ratio is considerably higher than its peers, and the gap will widen as other banking sectors find it easier to improve their loan quality”, it concluded.