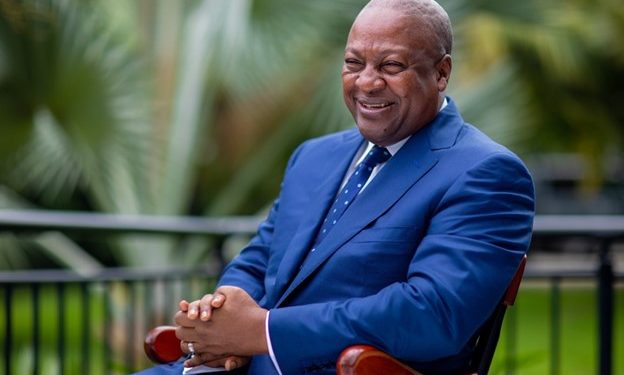

De-securitization of statutory funds to create GHS 19.4bn fiscal space for Gov’t – Mahama

Former President John Mahama, has said the de-securitization of proceeds from statutory funds like ESLA, GETFund and the District Assemblies Common Fund (DACF) coupled with the renegotiation of payments to Independent Power Producers (IPPs) will create a fiscal space of over GHS 19bn by 2025.

According to the former President, these measures when implemented by government, will first create a fiscal space of GHS 16bn in 2023, GHS 17.6bn in 2024 and then GHS 19.4bn in 2025.

Making the assertion while delivering an address on the economy titled Building the Ghana We Want at the University of Professional Studies, Accra on Thursday, October 27, 2022, Mr Mahama noted the aforementioned measures would significantly ease the cash-crunch which has crippled the affected sectors.

“We estimate that if the proceeds due ESLA, GETFund, Road Fund etc., are freed of the burden of collateralization and IPP payments are renegotiated, government would have access to a total of about GH¢ 16 billion in 2023, GH¢ 17.6 billion in 2024 and GH¢ 19.4 billion in 2025 from these funds alone.

“This would significantly ease the cash-crunch, which has crippled many sectors resulting in government’s inability to meet such basic obligations as supplying food to secondary schools and providing textbooks for basic schools,” he stated.

EXPENDITURE ITEMS FOR CONSIDERATION

| ITEM | 2023 INDICATIVE (GH¢) | 2024 INDICATIVE (GH¢) | 2025 INDICATIVE (GH¢) |

| GETFUND | 2,602,792,390 | 3,009,461,440 | 3,743,993,613 |

| ROAD FUND | 1,949,296,790 | 2,210,728,337 | 2,427,680,636 |

| MIIF | 1,817,296,790 | 2,005,210,007 | 2,329,783,372 |

| ESLA PLC | 5,028,665,684 | 5,715,321,520 | 6,480,628,825 |

| ENERGY SECTOR IPPs | 4,605,709,092 | 4,533,751,656 | 4,437,982,034 |

| TOTAL SAVINGS | 16,003,903,956 | 17,614,472,960 | 19,420,068,034 |

Speaking at the event, Mr Mahama urged government to stop the collateralizing statutory funds for the purpose of taking in more loans asserting that the wanton collateralization of statutory funds has been unhelpful.

On the way forward, the former President noted that a legislation prohibiting the collateralization of statutory funds should be passed by Parliament to ensure that such decisions are not made by future governments.

The de-securitization of statutory funds coupled with the renegotiation of payments to IPPs formed parts of measures to be implemented by the government to reduce the country’s huge public debt which is currently estimated at GHS 522bn.

Other measures to reduce the country’s public debt as proposed by he former president include;

- An immediate moratorium must be placed on all non-concessional borrowing.

- Government must actively canvass our bilateral partners for more concessional financing and grants.

- Stop Central Bank financing of government above the 5% threshold. The current printing of money to finance Government’s deficit is further fueling inflation.

- Reduce the size of government