Uganda’s Long-Term Foreign-Currency Issuer Default Rating (IDR) has been affirmed at ‘B+’ with a negative outlook by sovereign credit rating agency, Fitch Ratings.

The Long-Term Foreign Currency Issuer Default Rating assesses a country’s default risk in the issuance of debt instruments such as Eurobonds and foreign bonds.

The rating action, Fitch notes, reflects the country’s solid medium-term growth outlook and record of relative macroeconomic stability prior to the coronavirus shock, and an independent central bank that operates under an inflation targeting framework.

Further stating that the negative outlook reflects downside risks to public finances and growth from the coronavirus shock amid a build-up of government debt and persistent deficits which is expected to continue into the medium term.

“The government estimates that its budget deficit widened to 9.9% of GDP in the fiscal year ending June 2020 (FYE21), from 7.1% in FYE20, amid higher capital spending of about 1.9% of GDP in estimated coronavirus-related outlays. These increases in spending were only partly offset by a 1% of GDP increase in revenue, mostly relating to higher project support grants. The FY21 deficit is well above current and historical ‘B’ category medians,” said Fitch.

Find below details of Fitch’s rating action:

KEY RATING DRIVERS

Uganda’s ‘B+’ rating reflects its solid medium-term growth outlook and record of relative macroeconomic stability prior to the coronavirus shock, aided by an independent central bank that operates under an inflation targeting framework. The rating is constrained by low GDP per capita and low scores on World Bank Governance Indicators, with particularly low scores on political risk and control of corruption.

The Negative Outlook reflects downside risks to public finances and growth from the coronavirus shock amid a build-up of government debt and persistent twin deficits, which we expect will continue into the medium term.

The government estimates that its budget deficit widened to 9.9% of GDP in the fiscal year ending June 2020 (FYE21), from 7.1% in FYE20, amid higher capital spending of about 1.9% of GDP in estimated coronavirus-related outlays. These increases in spending were only partly offset by a 1% of GDP increase in revenue, mostly relating to higher project support grants. The FY21 deficit is well above current and historical ‘B’ category medians.

We forecast the fiscal deficit at 8.4% of GDP in FY22, with a shallower adjustment path for tax revenue and development spending compared with the government budget. Under the draft budget read on 10 June 2021, the government is planning sharp reductions of the deficit to 6.4% of GDP in FY22 and 3.8% of GDP in FY23.

We estimate that the government gross debt (at face value) rose to about 47% of GDP in FYE21, up from 41% in FYE1, including estimated domestic arrears of over 0.6% of GDP. This is still below current and historical ‘B’ category medians, but the gap is closing and we expect the debt ratio to exceed 51% of GDP in FYE21. Debt/revenue and interest/revenue ratios are already well above the ‘B’ medians.

Uganda and the IMF reached staff-level agreement on a three-year USD1 billion (2.7% of GDP) financing package in June 2021. We expect this to support Uganda’s fiscal adjustment and the resilience of fiscal and current account funding. We understand that the programme envisages gradual fiscal adjustment, supported by 0.5% of GDP per year in revenue gains (broadly in line with Uganda’s existing revenue mobilisation strategy), and a return of debt/GDP towards 50% by the end of the programme.

Higher deficits and a higher share of domestically-funded capital projects drove a surge in government domestic borrowing in FY21, to UGX5.7 trillion (3.9% of GDP or around 40% of the government’s annual borrowing requirement), from an average of UGX1.9 trillion in FY19-20. Domestic borrowing includes the accumulation of arrears (about UGX3 trillion or over 2% of GDP as of June 2021) against the Bank of Uganda (BOU) for debt service that BOU undertakes on behalf of the government.

The government expects to reduce domestic borrowing and meet nearly 70% of its financing requirement with mostly concessional budget support and project loans in FY22, including from the IMF, from about 60% in FY20-21. This should limit funding risks and the impact on the government’s budget, although a significant fraction of the external funding is yet to be identified.

Real GDP contracted by an unprecedented 1.1% in 2020 (calendar year). We expect real GDP growth to pick up to 4% in 2021 on the back of gradual normalisation of economic life after the coronavirus pandemic and ramp-up of oil infrastructure development. However, near term risks are to the downside, amid a contractionary fiscal stance and an ongoing renewed surge in coronavirus cases that began in May 2021, prompting the government to reintroduce some restrictions on gatherings and social mobility.

We expect oil infrastructure development to support a return of growth to 6% in the medium term, with potential for further upside. In April 2021, the Ugandan authorities concluded final agreements with international partners on development of oil production in the Lake Albert region. Upstream developments in Uganda are expected to deliver combined production of 230,000 bbl/day from early 2025, mostly to be exported via a new oil pipeline to Tanzania. The BOU estimates a 0.5% uplift to growth from related infrastructure development, some of which will be covered by the government, and a one-off boost of 2-3% when oil production comes on stream.

The current account deficit widened to 9.8% of GDP in 2020 from 7.4% in 2019 amid a collapse in net travel receipts and moderation in remittances. The goods trade balance improved largely due to a lower oil import bill. We expect the current account deficit to remain elevated at 9.3% of GDP in 2021, as a surging oil import bill offsets some recovery in travel receipts and remittances. We expect the deficit to shrink further in 2022 as fiscal consolidation gathers pace, tourism returns and oil prices retreat in line with Fitch’s baseline assumption.

We expect the current account deficits to be financed by government borrowing, including concessional project-linked borrowing and IMF disbursements, as well as foreign direct investment, partly linked to oil developments. We also assume that reserves will benefit from approximately USD520 million special drawing rights allocation later in the year. We also expect further non-resident inflows into Uganda’s local bond market, which surged to UGX2.4 trillion in June 2021 (over USD700 million or over 11% of domestically-issued debt), from UGX1.1 trillion in June 2020. Altogether, this should allow reserves to recover to USD4 billion by end-2021 (four months of current external payments), broadly in line with end-2020 levels.

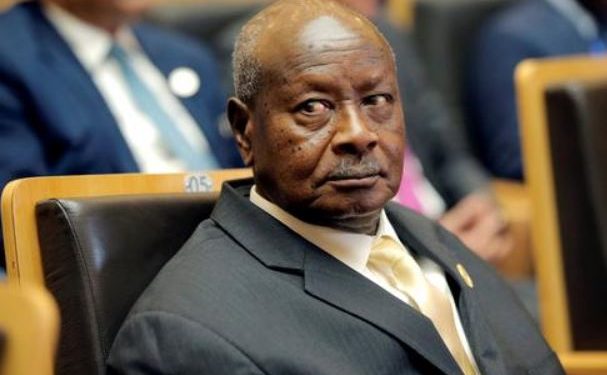

President Yoweri Moseveni, currently 76 years old and in office since 1986, was elected to another five-year term in January 2021. The election period was marked by deadly clashes between opposition supporters and security forces, multiple arrests of the main opposition candidate and a five-day internet shutdown enacted on the eve of the election. The US has imposed visa restrictions on some Ugandan officials, while the European Parliament adopted a resolution condemning the violence and calling for sanctions on the individuals responsible. For the time being, we do not expect domestic political tensions to impair Uganda’s ability to attract bilateral and multilateral funding. However, the risk is growing.

ESG – Governance: Uganda has an ESG Relevance Score (RS) of ‘5’ for both Political Stability and Rights and for the Rule of Law, Institutional and Regulatory Quality and Control of Corruption, as is the case for all sovereigns. Theses scores reflect the high weight that the World Bank Governance Indicators (WBGI) have in our proprietary Sovereign Rating Model. Uganda has a low WBGI ranking below the 33th percentile.

RATING SENSITIVITIES

FACTORS THAT COULD, INDIVIDUALLY OR COLLECTIVELY, LEAD TO NEGATIVE RATING ACTION/DOWNGRADE:

– Failure to slow the build-up of government debt and narrow fiscal deficits after the coronavirus shock.

– A sustained widening of the current account deficit or weakening of Uganda’s ability to attract long-term financing to cover it.

– A reduction in medium-term growth potential or a weakening of the macroeconomic policy-making framework.

FACTORS THAT COULD, INDIVIDUALLY OR COLLECTIVELY, LEAD TO POSITIVE RATING ACTION/UPGRADE:

– A narrowing of the fiscal deficit consistent with stabilisation in government debt/GDP, for example through higher domestic revenue mobilisation or improved expenditure rationalisation.

– A narrowing in the current account deficit, for example as a result of improved export performance.

– An improvement in GDP per capita, governance indicators or other structural factors relative to peers.