Emerging markets are exercising greater global sway

The global economy is increasingly influenced by the Group of Twenty’s large emerging markets. Over the past two decades, these economies have become much more integrated with global markets and are generating larger economic “spillovers” to the rest of the world.

At a time when growth prospects are weakening in China and several other large emerging markets, it is critical for policymakers—both in G20 emerging markets and those countries that could be impacted—to understand the channels through which a slowdown could propagate through the global economy.

Growth spillovers from domestic shocks in G20 emerging markets have increased over the past two decades and are now comparable to those from advanced economies, as we detail in an analytical chapter of the April 2024 World Economic Outlook. We also examine how such shocks spread through trade to companies and industries in other countries.

Spillovers are largest from China and they now explain just as much of the variation in emerging-market output as those from the United States. But other G20 emerging markets—such as India, Brazil, Russia, and Mexico—also play an important role in the economic performance of their neighbors.

Our simulations—using a multi-country multi-sector trade model—suggest that a decline in productivity in G20 emerging markets can lower global output three times more than would have been the case in 2000.

Industry spillovers

Since China’s accession to the World Trade Organization in 2001, G20 emerging markets have doubled their share of world trade and foreign direct investment and now account for one third of global GDP. They have become large importers of manufactured products as well as large exporters of intermediate goods, notably in manufacturing and mining.

And, as they have become increasingly integrated into global value chains, developments in G20 emerging markets can have a greater impact on businesses abroad.

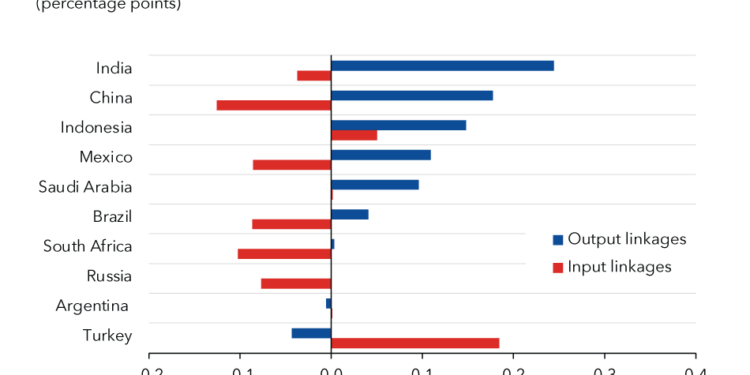

Positive growth surprises can boost the revenue growth of foreign firms in sectors such as electrical equipment, machinery, and metal products that are more dependent on demand from G20 emerging markets. Faster growth in emerging markets—such as Indonesia and Türkiye—can also help foreign firms in sectors that are more reliant on cheaper inputs.

But faster growth among emerging markets can also mean that they expand their productive capacity downstream to make and export new goods that compete directly with those goods made by firms overseas. This import-competition effect from lower-wage countries, such as China and Mexico, appears to dominate in sectors that are highly dependent on foreign suppliers—for example, textiles and chemicals.

It is therefore not surprising that shocks in G20 emerging markets can also trigger sizable reallocations of economic activity across countries and sectors.

Our modeling analysis finds that most sectors will shrink in response to a broad-based decline in productivity, especially in Asia. But spillovers are not uniform, particularly if the decline is concentrated in sectors that are integrated in global value chains. In that case, most manufacturing sectors in the rest of the world will eventually expand—particularly textiles, metals, and electronics—as firms take advantage of the decreased supply coming from G20 emerging markets.

Employment in countries hit by spillovers also adjusts. A positive productivity shock in G20 emerging markets can lead to job losses within the same sectors because of increased competition, whereas spillovers that propagate through sectors connected through global value chains tend to generate complementarities and more job opportunities.

Greater responsibility

G20 emerging markets—especially, but not only, China—have continued to make their presence felt as an important source of global and regional spillovers.

Negative spillovers from a G20 emerging market growth slowdown, especially following supply-side shocks, could put at risk the downward path in inflation for advanced economies. And in other emerging market and developing economies, spillovers can be larger, putting growth and income convergence at risk.

A slowdown in China could be especially costly given its role as a manufacturing powerhouse and its high integration. Yet the growing role of all G20 emerging markets means that others can help support the world economy. A plausible growth acceleration in these countries could generate positive global spillovers and boost world growth by half a percentage point.

The reallocation in activity and jobs across firms and sectors due to spillovers from G20 emerging markets can be costly, but it also creates new opportunities. Structural reforms, especially in labor markets and business regulation, can help sectors that stand to benefit most from reallocation. But policymakers should also deploy inclusive policies—including targeted fiscal support—that facilitate efficient reallocation of labor across sectors and mitigate any harmful distributional impact of the spillovers.

As global economic power continues to shift, effective multilateral cooperation and international policy coordination to manage spillovers and minimize fragmentation risks—including by strengthening the global financial safety net—remains a priority.