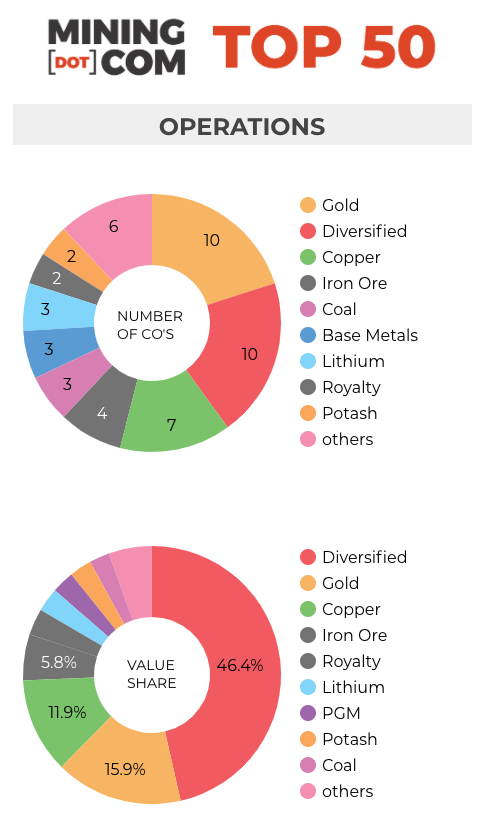

Despite gold’s price slump, strong copper and iron ore prices lifted MINING.COM’s ranking of the world’s 50 most valuable miners to a new record high of $1.35 trillion at the end of the first quarter.

The MINING.COM Top 50 most valuable mining companies added a combined $50 billion in market capitalization over the three months to end-March, a sharp slowdown compared to previous quarters, as the commodities rally cools and gold suffers its worst first quarter in decades.

Measured from the height of the pandemic in March-April last year, the index has now recovered by an astonishing $636 billion thanks to a boom in spending on green infrastructure – not only in China but across Europe and the US.

An indication of how widespread the rally in mining stocks was the past year is the fact that a year ago a valuation of just over $4 billion secured a company a spot in the Top 50 while today, number 50 on the list, Tianqi Lithium, is valued at more than $8.5 billion. Companies around the $4 billion market cap mark now sit in the mid-60s.

Iron ore IPO

Iron ore prices back above $170 a tonne lit a fire under the top producers, boosting BHP, Rio Tinto, and Fortescue’s value this year, and (with help of roaring platinum group metals) lifted Anglo American to position number four, the highest rank in years for the company with roots stretching back more than a century to Johannesburg.

One of the biggest mining IPOs since Glencore in 2011 came on the back of the steelmaking raw material’s performance with Brazil’s CSN Mineração debuting at 47 with a market value of over $9 billion as at 31 March. The mining unit of steel giant Companhia Siderúrgica Nacional currently produces about 33 million tonnes of ore per year, but has ambitious plans to triple that over the next decade.

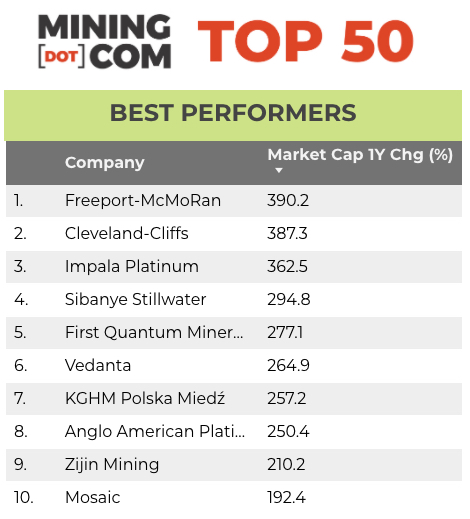

US iron ore producer Cleveland Cliffs managed to climb 35 spots over the past year, entering the top 50 for the first time after a nearly 400% rise over the past year.

Gold tarnished

Gold and silver’s relative underperformance saw a handful of gold companies, including B2Gold, Yamana, Kinross and streamer Royal Gold fall out of the top 50.

The combined value of gold, silver and streaming companies in the ranking now make up 16% of the index, down from 26% when gold prices were peaking in the third quarter of last year. The sector has lost over $50 billion in value since its peak, led by Barrick Gold, which bled more than $14 billion since end-September 2020.

That’s in stark contrast to platinum group metal producers which have jumped in the ranking – Impala is up 27 spots after a 360% jump and Anglo American Platinum has added 250% in value in US terms and now sits just outside the top 10. The Johannesburg-listed counters not only benefited from soaring PGM prices, but also a strengthening rand.

Based metals

Freeport McMoRan is up nearly 400% from its covid-lows last March, joined by other base metal miners in the top performers list. KGHM briefly dropped out of the Top 50 at the end of the first quarter but is now back at no 42 and Vedanta returns to the ranking at 34 from 53 a year ago.

First Quantum Minerals added nearly $10 billion in value over the past year and like Vedanta climbed 19 spots over the past year, only bested by PGM specialists.

Another indication of how broad-based the rally from pandemic lows a year ago is that among the worst performers only two companies – Shandong Gold and Coal India – actually showed a decline in value in US dollar terms over the past year.