4 Essential Insights From China On Financing The Energy Transition

This could be a pivotal year for China. Its CO2 emissions could fall for the first time since the country relaxed its pandemic restrictions in late 2022. The news follows a marked rebound in 2023 when emissions rose by almost 5% year-on-year, a new report from Carbon Brief finds.

The anticipated decline in CO2 emissions in 2024 will be the result of record increases in the deployment of new low-carbon energy capacity, especially wind and solar. Other factors include a rebound in hydroelectric power generation, and a decrease in emissions from power generation and heavy industry.

At its Annual Meeting of the New Champions, the World Economic Forum spoke to Dr Ma Jun – Founder and President of China’s Institute of Finance and Sustainability and Chairman of the Green Finance Committee at the China Society for Finance and Banking – about the country’s energy transition journey and key elements of its fight against climate change.

China’s emissions are declining, driven, in part, by green finance.Image: Carbon Brief

How has China led in green energy, from solar to electric vehicles?

China has been the biggest emitter of greenhouse gases globally, overtaking the US in the mid-2000s. While half of the world’s coal power stations are located in China, the country also has the world’s biggest renewable and hydroelectric capacity and is second-largest for nuclear after the US.

It has also become the world’s biggest maker and buyer of electric vehicles (EVs) and produces just over half of all lithium-ion batteries.

A range of factors have contributed to the company’s world-leading market share, not least policy, Dr Ma explained:

“It needs a lot of coordination by different departments and making sure that the conditions are right, that the infrastructure is ready for the growth of a particular segment of the green economy.”

He points to EVs as an example: “You need to not just produce the electric vehicle, but you also have to have the charging stations.”

The other major driver he highlighted is finance – “because you need money for production and money for buyers to purchase green goods.”

What are the foundations of successful green financing in China?

Dr Ma stressed that there are four key elements at the heart of China’s success in financing its green transformation.

The first is a clear taxonomy for what is considered as green activities.

“We define what green activities are. Then the finance sector can flow its money into these specific activities, including green energy, water treatment, solid waste treatment and the circular economy,” he explained.

“I led the drafting of the green banking taxonomy back in 2015. It’s a big table. At that time, it was 10 pages and more than 30 categories. Now it has evolved into 60 pages with over 200 categories of activities.”

Second, China has successfully created a raft of green financing instruments, from green loans and bonds to equity funds to channel money from the capital markets into green projects. Each project has different funding needs and risks and conditions vary, Dr Ma told the Forum.

“Some require short-term money, some require long-term money, some require money that can take risks. So we need many different financial instruments. We have green loans, green bonds, green equity funds, green insurance products and so on, to serve the entire green economy.”

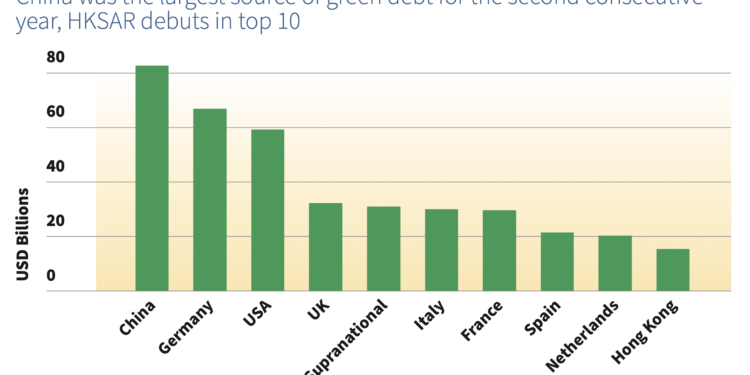

China is the global leader in green debt.Image: Climate Bonds Initiative

Dr Ma points to stringent rules on disclosure as the third success factor, enforced by both China’s central bank and the banking regulator.

“We require companies receiving green money – for example, green loans and green bonds – to report actual environmental benefits achieved.”

He added: “For example, if you claim you can reduce air pollution, tell me by how much. If you reduce water pollution, tell me how much. If you say you are reducing carbon, tell me the number of tonnes of carbon you have reduced through the project.”

The fourth ingredient in China’s green finance mix is financial incentives, because “many of these green projects may not be making enough initially to attract private-sector money”.

They are vital, therefore, to raising the attractiveness for investors at these early stages and driving bigger growth in the green economy, he added.

What has the impact of green finance pilot zones been?

One of the ways China has been trialling incentives is through a series of “green finance pilot zones”.

Established in the late 2010s, these zones were put in place to try out different green finance approaches tailored to the specific economic circumstances in these areas. Many of the finance options developed within each of the zones have served to establish best practices for national green financing initiatives.

China’s work on developing its green finance framework started in 2016, laying the foundations for China’s green growth in EVs, batteries and renewables.

“China has become the largest green lending market. We have outstanding green loans of more than 30 trillion renminbi, which is about $4.5 trillion. We also developed the largest green bond market with an outstanding amount of 2.5 trillion.”

The country has seen the benefits of its approach to the environment.

“You can definitely see that, in the last 10 years, air pollution in China has come down massively in cities like Beijing. I think the PM 2.5 values were around 90 on average, and they’re now about 30. That’s some 70% reduction in the air pollution that we’ve realized.”

China’s focus, Dr Ma explains, is now shifting from renewable energy and EVs to transition finance that will help its hard-to-abate industries decarbonize.