GSE Targets 10 Million Investors, 100 Listed Companies on Fixed Income Market by 2035

The Managing Director of the Ghana Stock Exchange (GSE), Abena Amoah, has outlined an ambitious vision for the Ghana Fixed Income Market (GFIM), aiming to expand the investor base from the current two million to 10 million Ghanaians and grow listed companies from seven to 100 over the next decade.

Speaking at the media launch of the GFIM’s 10th Anniversary Celebration on Wednesday, November 5, 2025, Ms Amoah said the Exchange intends to leverage technology and digital trading tools to boost participation and deepen financial inclusion in Ghana’s capital market.

“We want to see 10 million Ghanaians from the current two million opening securities accounts and actively trading on the GFIM market using technology and digital tools,” she stated. “We also want to see the government issue infrastructure bonds to develop roads, energy, schools, and hospitals in partnership with Ghanaian investors.”

Market Challenges

Ms Amoah highlighted several hurdles the market has faced over the past decade, including macroeconomic instability, limited corporate bond issuance, and concentration in government securities.

She cited exchange rate volatility, inflation, and fiscal pressures as key factors dampening investor confidence, adding that corporate bond activity remains modest despite regulatory support.

“Government debt instruments continue to dominate trading activity, limiting market diversification,” she said, emphasizing the need for continuous system upgrades to mitigate settlement and operational risks.

Lessons and Reforms

Reflecting on GFIM’s decade-long journey, Ms Amoah underscored the importance of collaboration, infrastructure, and education in fostering investor confidence and market growth.

“Strong trading, settlement, and reporting systems are essential for efficiency and trust. Building a culture of fixed-income investing requires continuous awareness and capacity-building,” she noted.

She further emphasized that the resilience of market reforms amid macroeconomic headwinds remains central to maintaining investor trust.

Outlook: Deepening the Market

Looking ahead, Ms Amoah outlined key priorities for the next phase of GFIM’s development. These include encouraging more private-sector issuances, expanding sustainable finance instruments such as green and social bonds, and enhancing regional integration through the African Continental Free Trade Area (AfCFTA) framework.

Technology and innovation, she added, will play a critical role in deepening market access and improving efficiency through fintech, blockchain, and data analytics.

Building on a Decade of Progress

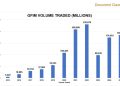

The GFIM, established in 2015, has evolved into one of Africa’s leading fixed-income markets, with over one trillion securities traded since inception. Ms Amoah said the Exchange remains committed to strengthening market infrastructure, promoting transparency, and driving inclusive economic growth.

“GFIM’s 10-year journey reflects transformation, resilience, and opportunity. The next chapter promises to build on this legacy, driving inclusive growth, sustainable financing, and regional leadership,” she concluded.