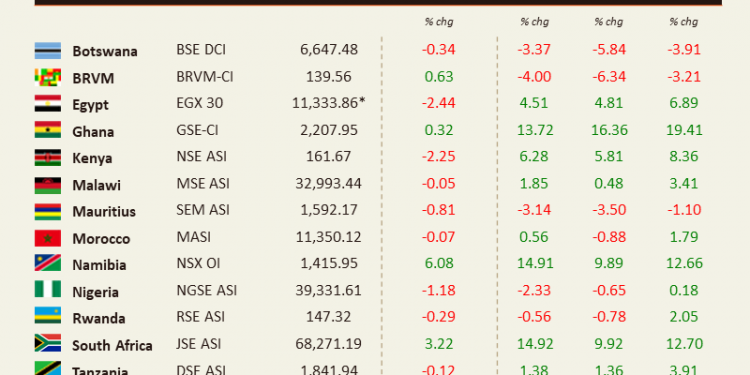

Overall sentiment on African equity markets was bearish. Among the markets we cover, 11 of them retreated this week and 6 advanced. Zimbabwe led the pack as equities in Harare soared 11.11%. Conversely, Egyptian equities lost 2.44% over the 5-day period.

West Africa

BRVM – Bulls set the tempo on the Western Africa regional exchange for another week. The Composite Index gained 0.63% in a thinly traded week that saw only XOF 305m (USD 0.55m) worth of shares change hands every day on average. This is in line with the daily average turnover of the week before. The market is now down 4% year-to-date and the total market capitalization stands at XOF 4,200bn (USD 7.6bn).

The top performer this week is the BICICI, BNP Paribas’ subsidiary in Côte d’Ivoire. The stock jumped 16.71% over the 5-day period but is still down 22.23% since the beginning of the year. The market heavyweight, Sonatel, closed the week at XOF 12,875, up 0.8% over the week. Shares in the telecom operator are down 4.63% year-to-date.

NGSE – Another week, another drop in Lagos. The benchmark index of the Nigerian stock exchange declined for the fifth-straight week closing on Friday at 39,331.61, down 1.18% WoW. YTD returns moved further in negative territory in local currency (-2.33%). Analysts at Greenwich Merchant Bank estimate that rising yields in the fixed income space continued to weigh on investor sentiment, while earnings for FY 2020 have not been very impressive.

Activity was strong this week as NGN 5.9bn (USD 15.61m) worth of shares was traded on average over the last five days, a 84% increase from the week before. The total market capitalization stands at NGN 20.6tn (USD 54.0bn). Among the Top 50 stocks by market cap, the best performer this week is Beta Glass Plc.

Shares in the producer of glass bottles and containers jumped 8% but remained down 2.53% YTD. Dangote Cement, on the other hand, remained flat for another week and closed the week at NGN 220. The shares in the cement producers are down 10.17% YTD.

North Africa

BVC – Morrocan equities barely budged this week. The MASI shed 0.07% in a quiet week that saw MAD 36.94m (USD 4.1m) worth of shares changed hands every day on average, or 60% drop from the week before. Total market capitalization stands at MAD 586bn (USD 65.1bn), up 0.56% YTD. Disway is the top performer this week.

The shares in IT equipment distributors rose 8.81% following the publication of strong results for 2020. Turnover grew 5% and net result jumped 24%. Besides markets participants cheered the 25% increase in dividend. The counter is up 12.06% YTD. The heavyweight Maroc Telecom closed at MAD 137.75 on Friday, up 0.4% WoW. The stock is down 5.0% YTD.

EGX – The Egyptian market retreated this week. The EGX 30 lost 2.44% and closed at 11,333.86 points on Thursday. Average daily turnover increased to EGP 1.48bn (USD 94.0m) and the total market capitalization amounts to EGP 689.9bn (USD 44.0bn). The benchmark index is up 4.51% so far this year. A notable performer this week is Egyptian Iron and Steel Co, the mining company.

The counter rallied 17.42% over the week but remains down 4.91% YTD. The Egyptian heavyweight, CIB, closed EGP 62.36 on Thursday, up 2.94% YTD. Fawry, the listed fintech, remains an investor favorite. Its stocks lost some steam to close at EGP 46.23 on Thursday, up 37.92% YTD.

East Africa

NSE – Kenyan equities tumbled this week. The Nairobi Securities Exchange’s benchmark index dropped by 2.25% WoW. Average daily turnover increased to KES 429m (USD 3.9m) and the total market capitalization amounts to KES 2,483bn (USD 22.7bn). The market is up 6.28% YTD. Nation Media Group topped the performance board for another week.

The shares in the regional media group soared another 57.45% WoW. Its plans to buy back 10% of its own shares from shareholders as well as the historical deal it struck with the NBA to air select matches of the most popular basketball competition in the world supported the stock. Shares are now up 64.08% YTD. Safaricom lost some ground this week as shares in the telecom operator closed at KES 37.30 on Friday, down 3.74% WoW. The counter remains up 8.91% so far this year.

Southern Africa

JSE – South African bulls were back this week. The JSE ASI gained 3.22% and closed at 68,271.19 while most global equities remained under some pressure with the continued volatility in the US bond market keeping investors cautious. South African equities are up 14.92% so far this year. The JSE heavyweight Prosus closed at ZAR 1,750.61 on Friday. It is up 8.99% so far this year.

ZSE – Bullish momentum prevailed in Harare. The ASI soared11.11%. Daily average turnover remained stable at around to ZWL 94m (USD 1.1m) and total market capitalization amounts to ZWL 557bn (USD 6.6bn). Zimbabwean equities are up 75% so far this year.