Why Kazakhstan’s Central Bank must protect price stability

As inflation soars around the world, central banks are racing to tighten monetary policy to deliver on their mandates of maintaining price stability.

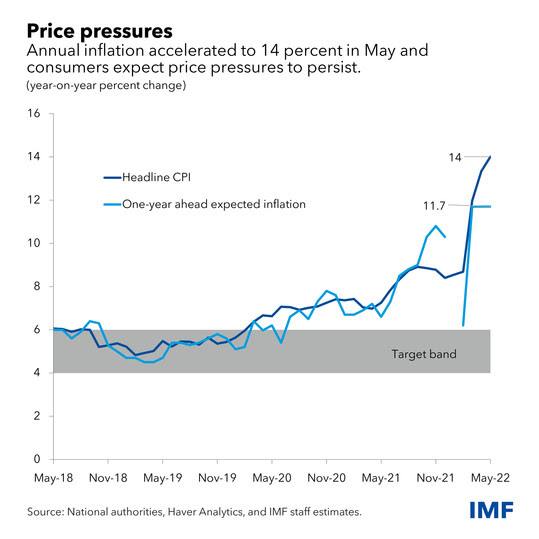

In Kazakhstan, raising interest rates has proved essential to avoid a spiral of inflation, currency depreciation and dollarization, as noted in our recent Article IV report.

Indeed, the National Bank of Kazakhstan may need to tighten monetary policy further to bring inflation back to target and anchor inflation expectations—even though that could weaken immediate economic growth.

Price stability is a condition for macroeconomic stability and sustainable economic growth. It also preserves standards of living. Inflation, by contrast, is the worst tax on the poor. It is critical that central banks maintain people’s trust in their ability to keep prices stable. This is why, across the world, price stability is their overriding objective.

As we see today, situations inevitably arise when countries face a trade-off between preserving price stability and supporting growth. This is when the independence and credibility of central banks is tested, and there is a risk that people lose trust in the monetary authorities’ ability to prevent prices from spiking.

Interest rates may then have to rise even higher to achieve the same stabilizing effect.

Targeting inflation in Kazakhstan

Kazakhstan has had a positive experience of transitioning to inflation targeting, where the central bank is mandated to maintain a certain level of price increases, rather than target growth, the money supply, or the exchange rate. The NBK’s increased focus on domestic price stability and reliance on exchange rate flexibility has helped anchor inflation expectations and absorb external shocks since 2015.

Yet the transition remains incomplete. More progress is necessary, including to diversify the economy, reduce dollarization, and limit exposure to external shocks. The long-term benefits are substantial, and the NBK’s Monetary Policy Strategy 2030 lays out comprehensive reforms to address many of these challenges.

At the same time, care must be taken to avoid broadening the NBK’s mandate or diluting its independence. Pursuing multiple objectives amid the challenges of keeping prices stable could hinder monetary policy effectiveness and accountability.

International experience suggests a more streamlined mandate for the NBK is desirable. Phasing out non-core activities, such as subsidized lending programs and other quasi-fiscal roles, would increase the effectiveness of monetary policy and the independence and credibility of the NBK.

Multiple shocks, multiple policies

Today’s economic environment—in Kazakhstan and the wider world—is characterized by multiple shocks: the COVID-19 pandemic, supply chain disruptions, the war in Ukraine and sanctions against Russia. Many public institutions have a role in implementing policies to lessen the immediate pain, especially for the most vulnerable, and support long-term growth and inclusion.

Governments can use fiscal policy to prop up domestic demand and growth, especially when high inflation limits the scope for monetary expansion. This is the case in Kazakhstan, where elevated oil revenues provide room for increased spending. Fiscal policy must, of course, strike a balance between supporting the economy, preserving fiscal sustainability, and maintaining macroeconomic stability.

In the long term, structural reforms are critical to growth, and this is certainly true in Kazakhstan where the state has a predominant role in the economy. The business environment must be improved to continue the transition to a market-based economy and to private sector-led diversification and job creation.

In this context, there should be no change to the central bank’s primary contribution as the guarantor of price stability. The NBK is more likely to achieve this if it has a clear mandate, strong credibility, and inflation expectations are firmly anchored.