World Bank Predicts Bigger Diaspora Remittance For Nigeria In 2024

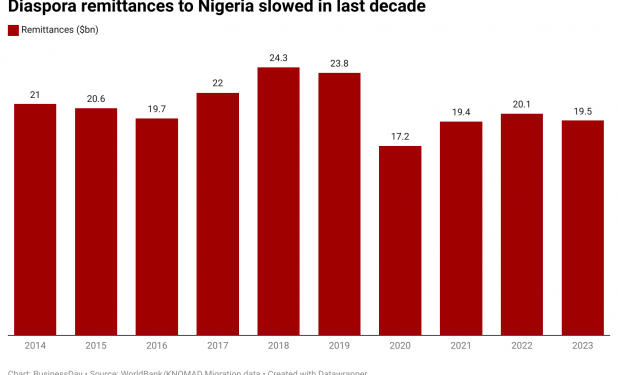

Nigeria has owned sizable shares of diaspora remittance, averaging $20 billion in foreign inflows in the last decade as such remittances become the most important foreign exchange earner in several countries for over a decade. This growth has however slowed in recent years.

In 2023, Diaspora remittances to Nigeria fell 3 percent to $19.5 billion from 2022 when it raked in over $20 billion, according to the World Bank Migration and Development Brief 40. This is part of the larger trend of a slowed recovery from the blow of the coronavirus pandemic.

The World Bank recorded that remittance flows to Low and Middle-Income Countries (LMICs), of which Nigeria is part, slowed between 2022 to 2023, reaching an estimated $656 billion in total, only 0.77 up, in contrast to the period from 2021 to 2022 when it rose by 8.3 percent.

Things could turn around this year, the World Bank predicts.

“The growth rate of remittance flows to LMICs is expected to recover to 2.3 percent in 2024 and 2.8 percent in 2025, to reach $690 billion in 2025” it said.

In Sub-Saharan Africa, inflow of foreign remittances is projected to recover slightly from negative growth of -0.3 percent in 2023 to +1.5 percent in 2024, with a further increase in subsequent years if things go well.

Access to local currency liquidity

In Nigeria, funds from citizens abroad serve as a critical lifeline, supporting everything from education and healthcare to infrastructure development and the country’s foreign exchange liquidity.

In June, the Central Bank of Nigeria (CBN) announced that international money transfer operators (IMTOs), would be given access to the official foreign exchange trading window known as the Nigerian Autonomous Foreign Exchange Market (NAFEM).

Under the new guidelines, IMTO operators can directly access the CBN window or via their Authorised Dealer Banks (ADBs) to execute foreign exchange transactions in the market. This way, they would pay recipients of international transfers at the going exchange rate.

This comes as Olayemi Cardoso, the CBN governor revealed plans to double diaspora remittances, which makes 6% of Nigeria’s GDP, in 2024.

W. J. Kanya, the acting director of the CBN’s Trade and Exchange department, said this decision was “aimed at widening access to local currency liquidity for the timely settlement of diaspora remittances.”

Increasing migration numbers

In 2023, remittance flows to Nigeria were supported by strong labour markets in the advanced economies, particularly in the United Kingdom and the United States, which stands as the largest source country for remittances and the primary destination country for migrants, the World Bank reported.

The recent World Migration report shows that over 400,000 Nigerians live in the UK as of 2020, and 2023 reports show over 300,000 visa applications to the UK were approved in 2023. Between April 2023 and March 2024, 255,000 visa applications to the US have already been approved according to British High Commission in Nigeria.

“The recovery of the job markets in the high-income countries of the Organisation for Economic Co-operation and Development (OECD), following the onset of the COVID-19 pandemic, has been the key driver of remittances, particularly as employment growth during the recovery was more rapid for immigrants than for the native-born,” said the international financiers.

Cost of sending money

Notably, sending remittances to Nigeria remains too expensive. In the fourth quarter of 2023, the average cost of sending $200(N219,800 as of December 2023) to Nigeria and other Sub-Saharan African countries was 7.9 percent (N17,364) of the amount being sent, which rose slightly from 7.4 percent, a year earlier and well above the SDG target of 3 percent.

The World Bank discovered that lack of competition and cross-border interoperability are the main reasons for high costs with banks. These costs tend to be lower when sent through digital channels or through money transmitters offering cash-to-cash services, which the organisation plans to invest in.

“Leveraging remittances for financial inclusion and capital market access can enhance the development prospects of recipient countries. The World Bank aims to reduce remittance costs and facilitate formal flows by mitigating political and commercial risks to promote private investment in this sector,” said Dilip Ratha, lead economist with the World Bank.

Remittance flows to Sub-Saharan Africa reached $54 billion in 2023, of which Nigeria accounted for 35.19%.

Future of diaspora remittances

Diaspora Remittances supported the current accounts of several African countries dealing with food insecurity, drought, supply chain disruptions, floods, and debt-servicing difficulties. Some countries like the Gambia, Lesotho, Comoros, Liberia, and Cabo Verde are heavily dependent on remittances to boost their GDP.

As remittances to Sub-Saharan Africa are projected to recover, Foreign Direct Investment flows, which have steadily decreased since 2012, are unlikely to, the World Bank predicts.

Inflows to Nigeria have already reached N841.35 billion in the first five months of 2024 as CBN reforms take effect, but while the outlook is promising, challenges persist.

The World Bank says that diaspora remittance growth could be trailed by “lower-than-expected growth in developed countries that will lead to a decline in remittances sent by the African diaspora.” Also, an escalation of the long-running conflict between Israel and Gaza could disrupt the supply chain, this including security risks in Nigeria, and climate risks including a pronounced drought in southern Africa.