World Bank Lowers Kenyan Growth Forecast on Floods, Protests

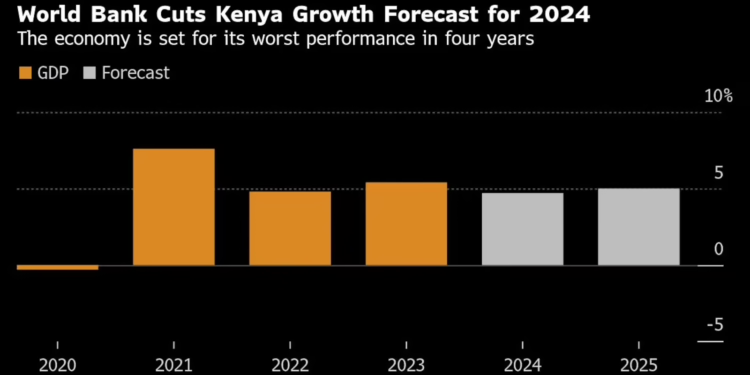

Kenya’s economy is heading for its worst performance since a coronavirus-induced contraction in 2020 because of floods and anti-government protests, according to the World Bank.

The Washington-based lender trimmed the East African nation’s 2024 economic growth outlook to 4.7% from 5% forecast in June, it said in an economic report on Kenya published on Tuesday.

Flooding and mudslides that killed more than 300 people in April and street protests that left dozens dead weighed on economic output, accompanied by the government’s push for fiscal consolidation through tighter spending, the lender said.

The World Bank expects growth of 5% in the coming year, softer than the 5.3% it previously estimated. The main risks to that outlook continue to be further fiscal slippage, extreme weather events and external economic challenges, it said.

“To sustain inclusive growth with more and better jobs, Kenya should address structural challenges, including ones related to fiscal sustainability, governance, weakening exports, lagging productivity growth, and increased frequency and intensity of climate shocks,” according to the report.

The nation continues to face a high risk of debt distress, with several indicators still showing weakness, according to the World Bank. Domestic debt — now Kenya’s biggest liability — remains expensive and of relatively short maturity periods, it said.

Missed revenue targets continue to undermine fiscal consolidation, necessitating budget expenditure adjustments. The key issue stems from overly optimistic revenue projections leading to revenue shortfalls and thereby missed targets, the World Bank said.