Record central bank buying lifts global gold demand – WGC

Central banks bought a record 399 tonnes of gold worth around US$20 billion in the third quarter of 2022, helping to lift global demand for the metal, the World Gold Council (WGC) said on Tuesday.

Demand for gold was also strong from jewellers and buyers of gold bars and coins, the WGC said in its latest quarterly report, but exchange traded funds (ETFs) storing bullion for investors shrank.

Gold is typically seen as a safe asset for times of uncertainty or turmoil, but many financial investors sold shares in gold-backed ETFs as interest rates rose and pushed up returns on other assets.

Offloading of bullion by ETFs helped push gold prices down 8% in the third quarter, but this price fall helped stimulate demand for jewellery, the WGC said.

In total, the world’s gold demand amounted to 1,181 tonnes in July-September, up 28% from 922 in the same period in 2021, the WGC said.

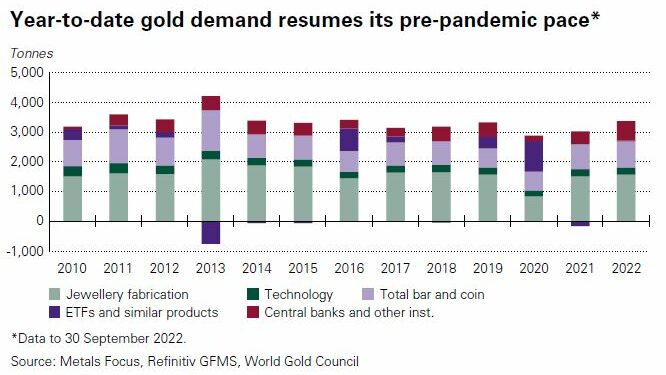

Demand in the year to September had recovered to pre-pandemic levels, it said.

Charting global demand for gold for the first nine months of every year since 2010.

Buying by central banks in the third quarter took their purchases for the year to September to 673 tonnes, more than the total purchases in any full year since 1967, according to the WGC.

Among large buyers were the central banks of Turkey, Uzbekistan, Qatar and India.

Purchases of gold bars and coins also surged in Turkey to 46.8 tonnes in the quarter, up more than 300% year-on-year, as people bought gold to shield themselves from rampant inflation.

“Looking ahead, we anticipate central bank buying and retail investment to remain strong,” said WGC analyst Louise Street.

“We also expect to see jewellery demand continue to perform strongly in some regions such as India and Southeast Asia,” she said.