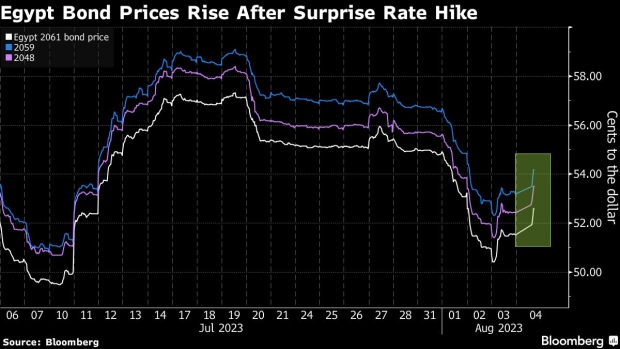

Egypt’s bonds rally most in emerging markets after rate hike

Egypt’s dollar bonds rallied the most in emerging markets after the nation resumed its monetary-tightening cycle, boosting optimism that authorities will get an IMF bailout back on track.

Debt due February 2016 rose 0.9 cents on the dollar to 53.4 for its biggest gain since July 14. Ten other Egyptian bonds occupied the best-performing slots in the Bloomberg Emerging Markets Sovereign Total Return Index. The extra yield investors demand to own the country’s securities rather than US Treasuries narrowed 3 basis points, according to indicative data from JPMorgan Chase & Co.

The central bank raised its benchmark interest rate to the highest level in records going back to 2006, underscoring its resolve to contain inflation hovering near 36%. That surprised economists who had expected no change at Thursday’s meeting. After all, Egypt had sought to build up its foreign-exchange reserves in the run-up to another currency devaluation, as part of a $3 billion rescue from the International Monetary Fund.

“The rate hike, although modest, is a signal the authorities are making efforts to get the IMF program back on track,” said Gordon Bowers, a fixed-income analyst at Columbia Threadneedle Investments in London. In the near term, the move may prevent “further credit ratings downgrades as it comes ahead of the conclusion of the Moody’s downgrade review, both of which are positive for Eurobonds,” he said.

The IMF has delayed its review of a $3 billion rescue program and billions of dollars in promised funding from Gulf Arab nations have yet to materialize as the potential lenders seek greater evidence that authorities are moving ahead with reforms — including genuine flexibility in Egypt’s currency.

Moody’s Investors Service placed the North African nation on review for a potential downgrade in May, citing increasing liquidity and debt-affordability risks. The ratings company cut the nation’s score to B3 in February.