Year of the bond starts with a $150bn spree

After optimism swelled for weeks that 2023 would finally bring relief for the world’s battered bond buyers, borrowers took advantage by issuing more than $150 billion of new debt in just four days.

The sales spree spanned the globe, from Hong Kong raising $5.8 billion via it’s biggest-ever green bond, to units of Credit Suisse Group AG issuing a combined $4.3 billion in US dollars and sterling, and Mexico selling $4 billion of dollar bonds.

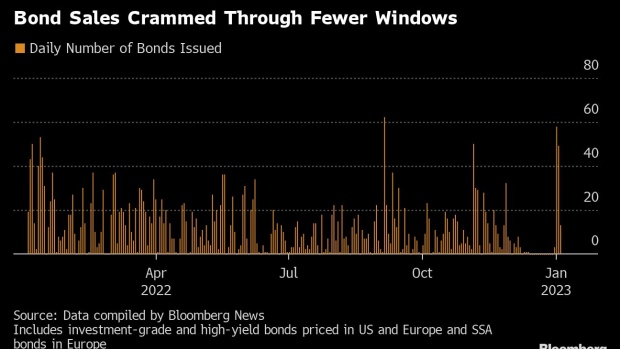

It was a fresh beginning for a market that suffered a whopping 16.25% loss last year. And while investors are off to a quick start in making back some of that money, the pace of this week’s bond rush shows that issuers are bracing for something that’s still very 2022: volatile markets where the opportunity to borrow can slam shut faster than you can say consumer price index.

Barclays Capital’s investment-grade debt syndicate co-head, Meghan Graper, explained the situation last month at a Bloomberg Intelligence event in New York. With so much uncertainty around inflation and the direction of the economy, investor appetite can be easily ruined by any number of data points or policy discussions — CPI, consumer confidence, central bank meetings or speeches. The extra premium demanded on the days of such events tends to scare away borrowers, leaving them all trying to cram their offerings into days where the chance of a big surprise seems low, she said.

“Three quarters of supply in any given month this year came in a matter of five business days,” Graper said at the Dec. 15 event. “We’ve had a record setting zero-volume days in the primary market. And then everybody running through the same narrow window.”

The trend is likely to continue this year, she said. Which means companies that need to borrow will not only have to navigate higher interest rates but also the risks of getting the timing wrong. Even on those all-in days, bond buyers can test the market’s limits. After a $53 billion, 48-hour sales binge in the US corporate bond market, investors started demanding larger concessions to buy the debt, Bloomberg’s Brian Smith noted.

China Relief

China’s embattled property developers got more good news this week. Beijing is planning to relax the so-called three red lines restrictions it had placed on the sector, which exacerbated one of the biggest real estate meltdowns in history, Bloomberg News reported this week.

The move could be the most significant of a string of measures that China has put in place to bolster the industry, which accounts for about a quarter of the nation’s economy. The nation’s developers defaulted on more than 140 bonds last year, missing payments on a combined $50 billion in domestic and international debt issues.

Elsewhere:

- China Evergrande Group, the developer at the epicenter of the nation’s property crisis, is planning its first in-person meeting with members of a major offshore bondholder group.

- Retailer Bed Bath & Beyond has started preparing for a bankruptcy filing after a worse-than-expected holiday season and a failed debt exchange proposal. The company’s turnaround plans will mainly revolve around the fate of its prized Buybuy Baby brand, Bloomberg’s Eliza Ronalds-Hannon wrote.

- Party supply chain Party City is also headed toward a Chapter 11 filing in a deal that could hand the keys to creditors.

- Bankrupt crypto exchange FTX’s caretakers reached a deal with liquidators in the Bahamas that settles most of the disputes that had threatened to disrupt the cleanup of Sam Bankman-Fried’s failed digital asset empire.

- The asset management arm of Goldman Sachs led one of Italy’s biggest ever deals in the private credit market, a €700 million loan to support the private equity investment in pharmaceutical firm Neopharmed Gentili SpA.