Yield hunt is back as bond spree lures risk takers to Africa

Burgeoning demand for junk-rated sovereign debt is prompting comparisons with some of the frothiest bouts of yield-hunting in emerging markets, but with major caveats.

Recent debt sales in Africa show how investors are snapping up riskier bonds as the prospect of interest-rate cuts in the US takes benchmark yields off their peaks.

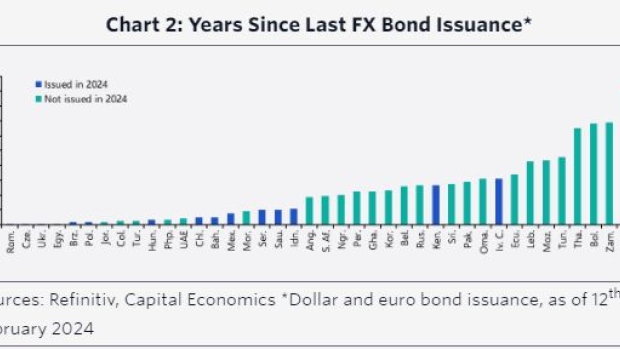

Kenya, rated five levels below investment grade at S&P Global Ratings, got orders for more than three times the $1.5 billion it put on sale Feb. 12. A week earlier, Benin’s dollar bonds were more than six times oversubscribed. It was a similar story for Ivory Coast’s sale in January, when it offered the first eurobond from the continent since April 2022. Total sub-Saharan issuance has already surpassed Goldman Sachs Group Inc.’s forecast of $4.5 billion for the entire year.

“The last time we saw an outbreak of yield chasing akin to this one was in mid-2018 or so,” said Peter C. Earle, senior economist at the American Institute for Economic Research. At the same time, “the undiscriminating emerging market bidders that we’d seen for many years are probably gone,” he said.

In the years before the pandemic, emerging and frontier borrowers attracted eager bond buyers as waves of central-bank purchases and stimulus turned yields negative on nearly $16 trillion of debt. Tajikistan, the poorest state in central Asia, epitomized the froth, netting more than $3 billion in bids for its $500 million debut in 2017.

As economies buckled amid the Covid-19 lockdowns of 2020 and 2021, a slew of defaults followed. There were 14 separate default events since 2020, across nine different sovereigns according to Fitch Ratings. That compares with 19 defaults across 13 different countries in the preceding two decades.

Ghana, among the last issuers to sell in March 2021 before investors turned cautious, reneged on its debt a little more than a year later.

This time round, a default loop isn’t in the cards, according to Earle and other emerging-market specialists. With the Federal Reserve eventually set to ease policy, the backdrop is much more supportive for high-yield issuers.

“The key difference is the direction of US rates,” said Charlie Robertson, head of macro strategy at FIM Partners UK Ltd. in London. “Debt loads are manageable if markets are prepared to roll over debt, and last month’s issues show Africa can roll over.”

Nigeria, Angola and El Salvador have bonds coming due in 2025 and are “prime contenders” to issue next, according to Morgan Stanley analysts. “External factors are shifting in the right direction,” they wrote. “It would be credit-positive if they are able to issue.”

At the same time, investors are still coming to terms with the shift higher in developed-market yields. Given the returns available on safer debt, they’re having to pick more carefully among emerging and frontier assets, with a focus on nations that keep a lid on spending or show progress on reforms.

Investors aren’t in a “buy anything if the yield is high enough” mindset, but a “buy anything with good fundamentals and high yield,” said Franck Bekaert, senior emerging-market analyst at GimmeCredit.

Increasing action from multilateral lenders like the International Monetary Fund and World Bank has also reduced the risks.

The Washington-based IMF provided more than $50 billion to the region between 2020 and 2022 — more than double the amount disbursed in any 10-year period since the 1990s.

That support could also help lower the cost of borrowing for the recipients by creating a scarcity premium on their bonds, according to Shamaila Khan, head of emerging markets at UBS Asset Management.

“We can start to see more issuance from higher yielding countries,” she said. “But considering the availability of additional funding from concessional sources it is going to be significantly lower than historical levels.”