Ghana Must Adopt Global Debt Accounting Standards to Avoid Fiscal Space Illusions – EGP Coordinator

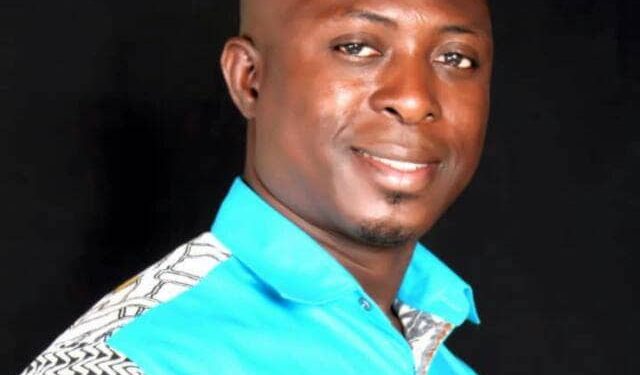

Ghana must adopt internationally accepted debt accounting standards to prevent the misrepresentation of its fiscal position and unsustainable borrowing, according to AbdulKarim Mohammed, Coordinator of the Economic Governance Platform (EGP).

Speaking at the CSO Budget Forum on inputs for the 2025 budget, Mr. Mohammed emphasized that debt has consistently been at the center of Ghana’s economic crises and International Monetary Fund (IMF) interventions.

He noted that inconsistencies in debt reporting have created a false perception of fiscal space, encouraging excessive borrowing.

“We have had a situation where, in the recent past, the Ministry of Finance determined which type of debt must be captured in our national debt. That gives a misleading impression of fiscal space, allowing further borrowing,” he said.

He cited the Sinohydro infrastructure-for-bauxite deal, the financial sector bailout, and energy sector debts as examples of obligations not fully reflected in Ghana’s public debt stock. “When such liabilities are omitted, it distorts the true picture of the country’s fiscal health,” he added.

Touching on the upcoming 2025 budget and with the government planning to abolish certain taxes, including the e-levy and COVID-19 levy, Mr. Mohammed warned that revenue shortfalls could further strain public finances.

He called for stringent expenditure control, urging a review of the public sector wage bill and underperforming state-owned enterprises (SOEs).

“The government has taken commendable steps, such as reducing the number of ministers, but more can be done. Many SOEs are overstaffed and hemorrhaging the economy. We need to assess their viability and determine if they should still be maintained on government books,” he stated.

He also urged authorities to postpone non-urgent expenditures, such as gratuity payments under the ex-gratia system, and instead prioritize social spending to cushion the economically vulnerable.

Mr. Mohammed further called for decisive measures to curb financial irregularities highlighted in the Auditor-General’s report, stressing that plugging fiscal leakages is critical to improving the country’s economic stability.

His remarks come as the government prepares to present the 2025 budget, with businesses and investors closely monitoring how fiscal consolidation measures will be implemented to restore macroeconomic stability.