Africa’s biggest economies set to hold interest rates as inflation risks linger

Central banks in Africa’s biggest economies are set to diverge from their emerging-market peers in Latin America and Europe over the next two weeks, as they maintain tight monetary policies to contend with persistent inflation.

Egypt, South Africa, Morocco, Kenya and Ghana are poised to keep their key interest rates at current levels while they assess risks to inflation from domestic and global factors, including geopolitical tensions in the Middle East. Nigeria’s rate decision looks like a toss-up between a hike and a hold.

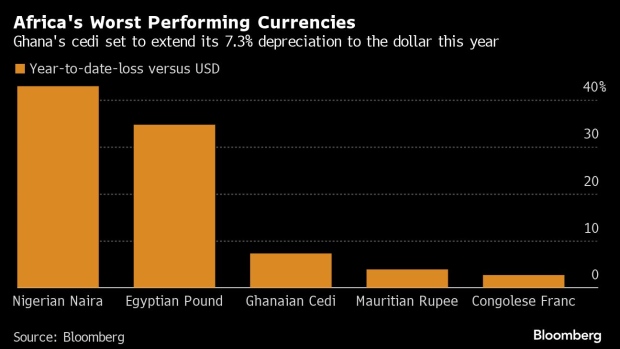

Nigeria, Egypt and Ghana are facing upward price pressures from currency weakness, while South Africa is feeling the impact on food prices from hot and dry weather conditions. A change in the Federal Reserve’s forecast for interest rates that projects it delaying easing could also become a risk factor for African currencies.

Morocco, March 19

- Benchmark rate: 3%

- Inflation rate: 2.3% (Jan.)

Morocco’s central bank is expected to remain cautious and keep the key interest rate steady even as inflation is at its lowest level in more than two years.

The Bank Al-Maghrib council will probably opt to keep the rate at 3% throughout the year, forecast Attijari Global Research, the research unit of Morocco’s biggest lender. That’s as the kingdom seeks to safeguard its currency peg with the euro and dollar. It will probably only pivot after the Fed and European Central Bank start easing.

Ghana, March 25

- Policy rate: 29%

- Inflation rate: 23.2% (Feb.)

- Inflation target: 8% +/- 2 ppts

After cutting interest rates for the first time since 2021 in January, the Bank of Ghana will be circumspect about doing so again. That’s as the cedi, Africa’s third-worst performing currency this year, is likely to continue to weaken, placing upward pressure on prices.

The inflation rate unexpectedly climbed in January before easing slightly last month and is predicted to rise again.

“A bigger increase in inflation is expected in March which could lift the rate close to the 25% mark before the decline starts again in April. So the monetary policy decision will be to hold the rate and observe how things unfold before they make the next move,” said Courage Boti, an economist at Accra-based GCB Capital Ltd. “If there will be a cut then the earliest will be in May.”

Nigeria, March 26

- Policy rate: 22.75%

- Inflation rate: 31.7% (Feb.)

- Inflation target: 6%-9%

Having raised the benchmark interest rate by 400 basis points last month and the minimum cash reserve ratio for banks to 45% from 32.5%, analysts are split on whether the Central Bank of Nigeria will deliver another rate hike.

Mohamed Abu Basha of EFG Hermes Holding anticipates the CBN will stand pat, because the action last month has steadied the naira, which will help cool inflation. “Not only is the official rate stabilizing, but we are also seeing near-full conversion with the parallel market, in an addition healthy sign for the naira,” he said.

The central bank has devalued the local currency twice since June and narrowed the gap between the policy rate and yields on short-dated paper to attract foreign inflows.

Conversely, Rand Merchant Bank’s Oyinkansola Samuel and Usoro Essien forecast the monetary policy committee will lift the key interest rate by 100 basis points to contain inflation, which they see peaking at 33.1% in May due to naira weakness.

South Africa, March 27

- Repurchase rate: 8.25%

- Inflation rate: 5.3% (Jan.)

- Inflation target: 3%-6%

With inflation risks lingering, policymakers at the South African Reserve Bank are also expected to remain guarded and maintain the benchmark rate at a 15-year high of 8.25% until at least the third quarter.

“The SARB is still very worried about, firstly, upside risks to inflation stemming from things like administered prices, a potential spillover into wage inflation because we’ve had a sharp rise in cost of living,” said Sanisha Packirisamy, an economist at Momentum Investments. “But also, from the global dynamic, because we’ve had the Red Sea conflict and there is still potential for an upside surprise on energy and food prices.”

Egypt, March 28

- Deposit rate: 27.25%

- Inflation rate: 35.7% (Feb.)

- Inflation target: 7% +/- 2 ppt

After enacting its highest ever interest rate hike on March 6, Egypt’s central bank will likely pause its monetary tightening when policymakers meet.

The North African nation increased rates by 600 basis points, minutes before allowing its currency to lose almost 40% of its value against the dollar.

While inflation unexpectedly quickened in February, the central bank is not expected to “react that soon,“ said Basha. “It’ll probably prefer to wait through March-April inflation numbers before further potential tightening.”

Kenya, April 3

- Central bank rate: 13%

- Inflation rate: 6.3% (Feb.)

- Inflation target: 5% +/- 2.5 ppts

Kenya’s monetary authority is likely to leave the benchmark rate unchanged after aggressive tightening in December and February. The currency has also gone from being one of the worst performing currencies in the world to the best in less than three months, after the East African nation offered to buy back part of $2 billion of debt and announced plans to sell new securities.

Inflation risks have diminished due to the deceleration of the primary drivers, namely food and fuel prices, according to Stephanie Kimani, an economist at Nairobi-based I&M Group Plc. The best bet for now is a hold, “given that the principal motivation for previous hikes was in aid of Kenyan shilling,” she said.