Big rate hike in play for Angola as currency slides, inflation soars

Angola’s central bank is poised to raise borrowing costs to cool inflation that’s at a four-month high and shore up its currency, at its first rate-setting meeting to be presided over by Governor Manuel Tiago Dias.

Economists told Bloomberg that they expect the monetary policy committee will lift the key lending rate, currently at 17%, by 200 basis points to 300 basis points on Friday. A hike would be the first this year after two successive cuts and a hold.

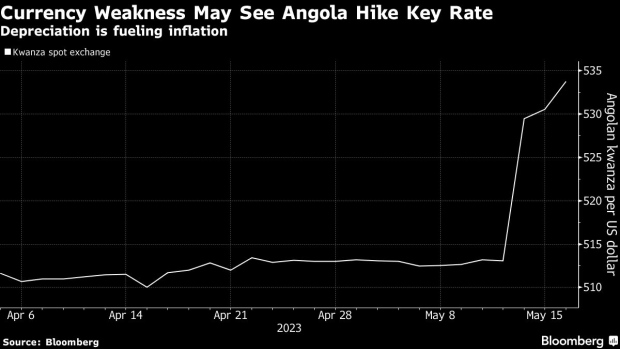

The annual inflation rate in Africa’s third-biggest oil producer rose to 11.25% in June from 10.6% in the previous month. It’s seen staying elevated after the government cut subsidies for gasoline last month and Treasury abstained from dollar sales in April and May, accelerating the depreciation of the kwanza against the US currency to almost 39% since then.

Against the backdrop of a rapidly depreciating exchange rate since mid-May and the removal of fuel subsidies threatening inflation, the MPC could hike by up to 200 basis points at this meeting, Absa Group Ltd. economists Ridle Markus and Mpho Molopyane said in a research note on Monday.

Wilson Chimoco, an economist at Universidade Catolica de Angola, predicts a hike to 20% or “more” accompanied by an increase in the reserve requirements for the local currency.

The move will help manage businesses’ inflation expectations, Chimoco and Euriteca Andre, a Luanda-based economist and university lecturer, said.

The central bank, whose governor was replaced in June, is planning to revise its inflation target of between 9% and 11% for the end of 2023.

Fitch Ratings said in a report on June 23 it expects a weaker kwanza to be one of the main drivers of upward pressure on inflation given the country’s reliance on imported food. It forecasts inflation to average 14.7% in 2023 and increase to 17.1% in 2024.

Complicating the calculus is the impact a rate hike will have on economic growth. The economy contracted for the first time in almost two years in the three months through March, compared with the prior quarter.