China Corporate Bond Default Rate Set to Rise in 2022

China’s corporate bond default rate will be pushed up by privately owned property developer defaults in 2022, but defaults on capital market debt from the state sector, including local government financing vehicles (LGFVs), are likely to remain at a similar or modestly higher level than in 2021, says Fitch Ratings.

The number of issuers that defaulted on publicly issued bonds last year in China’s onshore market was similar to 2020, at 37. Among these, 12 were state-owned enterprises (SOEs), up from eight in 2021, but none of these defaults caused the sort of significant market volatility that followed those of SOEs like Peking University Founder Group, Huachen Auto and Yongcheng Coal in 2020.

Seven out of the 12 SOEs defaulted for the first time on any debt instrument in 2021, and before default had already shown meaningful signs of distress. The remaining five were not first-time defaulters, but continued to default on instruments coming due in 2021. The remaining 25 defaulted onshore issuers from 2021 were privately owned enterprises (POEs), including nine property developers.

The overall onshore corporate bond default rate remained low at 0.76% of issuers in 2021, down from 0.84% in 2020. The default rate among POE issuers was much higher at 3.0%, albeit roughly on a par with 2020.

A total of 15 issuers defaulted on offshore bonds in 2021. All except one were POEs, including 10 property developers. These pushed the offshore Chinese corporate default rate up to 2.8% of issuers in 2021, compared with 2.5% in 2020.

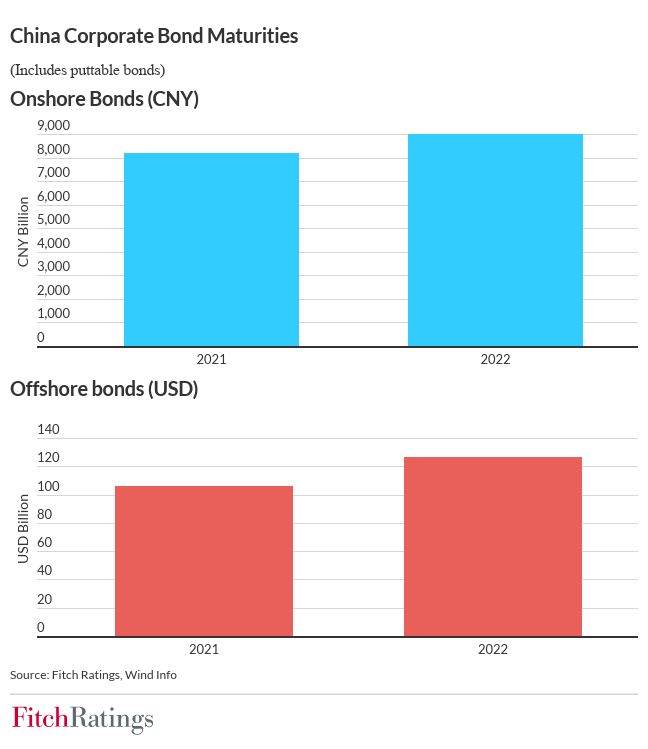

We expect access to debt capital markets to remain curtailed for most privately owned developers in the first half of 2022, with refinancing activity significantly limited until investor confidence improves.

The sector’s maturing or puttable bonds will also jump to USD30 billion in 1H22 from USD21.2 billion in 2H21 and USD27.9 billion in 1H21. These trends should result in more developer defaults, including distressed debt exchanges, pushing up China’s aggregate corporate default rate.

Outside the property sector, onshore and offshore issuer bases are both dominated by SOEs (including LGFVs), as many POE issuers have exited the bond markets amid weak investor sentiment towards POEs in general.

We do not expect a material pick-up of defaults from the SOE sector in 2022, as the broad liquidity environment should remain relatively favourable for SOEs in general, at least in the first half. This reflects in part modest policy easing, designed to support economic growth. It also reflects heightened political sensitivity, and awareness and accountability among local and regional government (LRG) officials around the risks to regional systemic financial stability posed by default shocks involving high-profile SOEs and LGFVs.

We expect local governments to take steps to minimise unexpected, disorderly bond defaults in 2022, but they cannot be entirely ruled out. Levels of corporate liquidity management experience and knowledge of debt markets and cross-default risk vary among officials, and it is possible that some may underestimate capital market reactions, or step in too late to provide sufficient support.

Bond defaults will be more likely among entities with concentrated maturities that are already suffering curtailed or intermittent access to capital market financing, as well as those that have had to pay above-market rates to issue new capital market debt. Weak SOEs in commercially oriented sectors and highly leveraged LGFVs owned by lower-tier LRGs in less developed regions are more vulnerable.

Distressed entities may look to prioritise repayment of capital market debt over other forms of debt. However, those with offshore bonds outstanding could face higher cross-default risk, should a default on non-capital-market debt occur.