Editorial: Please come again Mr Finance Minister, Ghana’s debt stock not GHS 450bn but more than GHS 596.3bn

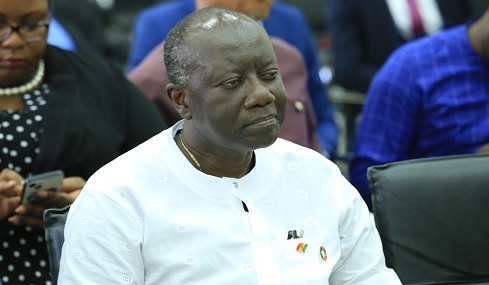

Making a case for himself and mounting a defense against his censure as the country’s Finance Chief by the Minority in Parliament on Friday, November 18, 2022, Mr Ken Ofori-Atta responding to a question about the value of the country’s total debt stock in cedis, pegged the country’s total debt stock at GHS 450bn.

But wait a minute, was the country’s total debt stock not GHS 402bn at end-July 2022 as reported in the Bank of Ghana’s (BoG) October 2022 Summary of Economic and Financial Data.

So where then from the GHS 450bn total debt stock figure? Or did the Honourable Finance Minister add short term debt issuances made on the domestic market from August to mid-October to arrive at the new GHS 450bn figure? Or recalculate the debt figure to account for the recent depreciation of the local currency?

Well, no one knows except the Finance Minister himself.

But just like the many economic experts/analysts who believe the GHS 450bn is not a true reflection of the country’s total debt stock, we are at norvanreports, think so too.

A look at the year-to-date depreciation of the local currency (cedi) should give you a clue to the enormous impact/toll it will have on the country’s debt stock.

In norvanreports’ view, the country’s debt stock is way above the GHS 450bn stated by the Finance Minister, should we even decide to maintain the country’s external and domestic debt stock of $28bn and GHS 190.3bn respectively at the end of July 2022.

That is, assuming the government since July this year, hasn’t made any borrowings either externally or locally – which by the way government has been doing through the issuance of its 91 day, 182 day and 364 day treasury bills. Then there is also the recent $750M Afreximbank loan.

But as noted earlier, lets assume government has made no borrowings since July and its external and local debt still stands at $28bn and GHS 190.3bn respectively.

Accounting for the impact of the cedi depreciation pegged at 52% against the anchor currency – US dollars – which has seen the value of the cedi drop to GHS 14.50 to $1 on the retail market, the country’s external debt in cedis terms now stands at GHS 406bn ($28bn × 14.50).

Plus the domestic debt component which is GHS 190.3bn, the value of the debt stock jumps to GHS 596.3bn, almost GHS 600bn.

Granted that we ignore the GHS 14.50 to $1 exchange rate used on the retail market and use the exchange rate provided by the Central Bank which as of Monday, November 21, 2022 was GHS 13.10 to $1, the country’s debt stock is still way above the GHS 450bn quoted by the Finance Minister.

Using the GHS 13.10 to $1 exchange rate provided by the Central Bank, the country’s external debt in cedis terms will be GHS 366.8bn ($28bn × 13.10).

Plus the domestic debt component which is GHS 190.3bn, the value of the debt stock jumps to GHS 557.1bn.

On Monday, November 28, 2022, the Bank of Ghana will release its Summary of Economic and Financial Data for the month of November 2022, should the external component only, or both the external and local components of the public debt stock increase, Ghana’s total debt stock in cedis terms given the prevailing exchange rate, is likely to inch close to or rise above GHS 700bn.