GCB aims to increase CAR to 14% by year-end; 18% by 2025

State-Owned Bank, GCB, has planned to increase its Capital Adequacy Ratio (CAR) from the current 7.59% at December 2022 to 14% by the end of this year.

The Bank further looks to increase its CAR to 18% by end-2025 significantly outstripping the Bank of Ghana’s mandatory CAR requirement of 13%.

The decline in the Bank’s CAR to 7.59% at end-December 2022 was on the back of the Government’s Domestic Debt Exchange Programme (DDEP) which saw the re-structuring of some GHS 130bn in domestic debt resulting in impairment losses and capital adequacy issues for the Bank.

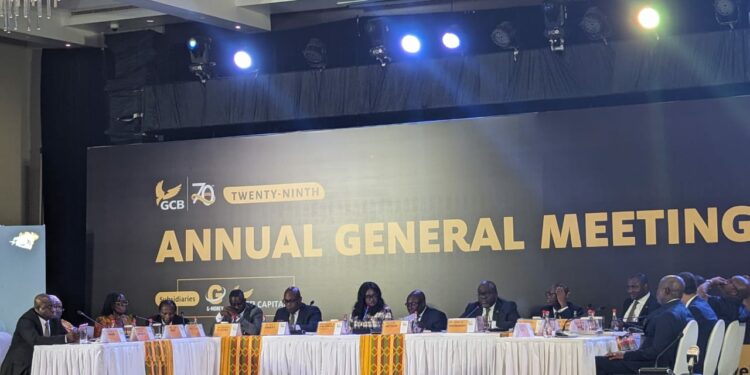

The Bank’s goal of increasing its CAR to 14% this year is underpinned by an additional equity capital of GHS 1bn provided by shareholders in a special resolution passed during the Bank’s 29th Annual General Meeting on Friday, June 30, 2023.

The GHS 1bn additional equity capital which constitute a Common Equity Tier 1 Capital of GHS 750m and an additional Tier 1 Capital of GHS 250m preference shares, is to among others:

- meet regulatory capital adequacy ratio requirements

- enhance deal-making capacity and take advantage of opportunities available to the Bank while preserving its core strengths

- strengthen access to funding markets and bolster confidence in the Bank

- support targeted and prioritized investment in digital transformation and ultimately help to drive business strategy.

GCB within the 2022 review year, saw its Total Operating Revenue grew by 24 percent to GHS 3.0 billion.

This was underpinned by broad based growth across all the key revenue lines. Net interest income was up 11 percent, fees & commissions grew 7 percent.

Trading Income was phenomenal with a growth of 208 percent to end at GHS 487 million. Operating cost went up 29 percent recording GHS 1.6 billion on account of inflationary and currency depreciation effects.

Pre-provision profit was up 22 percent to close at 1.4 billion reflecting the good progress the Bank made during the year in executing its strategy.

Profit before tax was however a loss of GHS 743.5 million owing to impairment charge of GHS 2.1 billion.

The impairment charge for the year largely reflects the impact of the DDEP on the Bank’s investments holding in government securities.

Total assets grew from GHS 18.4 billion in 2021 to GHS 21.5 billion in 2022. This strong performance was on the back of 28 percent growth in customer deposits which moved from GHS 13.9 billion in 2021 to GHS 17.8 billion in 2022.

Total loans and advances grew 27 percent from GHS 4.3 billion to GHS 5.5 billion in 2022.