Ghana wins debt moratorium until 2026 from Official Creditors

Ghana has won a moratorium with official creditors on debt payments through May 2026, and expects to reach a deal with eurobond investors to revamp $13 billion debt by the end of March.

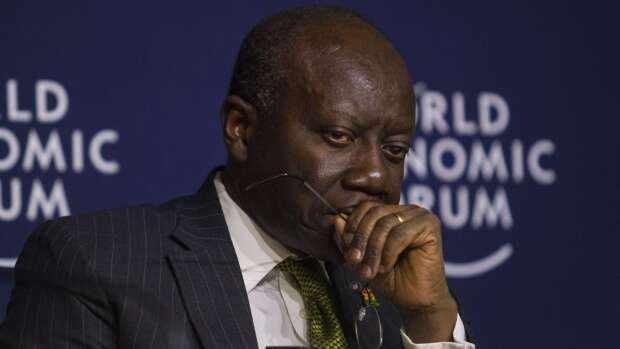

Finance Minister Ken Ofori-Atta said the payments owed on $5.4 billion of bilateral obligations would be repaid in two tranches in 16 and 17 years’ time, under the terms of the deal struck in principle last week. It was the first time he has publicly shared these details of the pact.

Speaking from the World Economic Forum in Davos, he said the agreement with official creditors also “builds momentum and confidence” to revamp the eurobond debt.

“There’s a sense globally that Ghana has done its part and therefore talking to the eurobond investors, there’s a sense of urgency,” he told Bloomberg.

Ghana’s pact with official creditors, announced Jan. 12, means debt payments from 2023 would be repaid in 2039 and 2040, while debt service due in 2024 would be repaid in 2040 and 2041, he said. The forbearance will run for the duration of Ghana’s program with the International Monetary Fund that ends in May 2026.

Ghana’s pact, finalized in just over a year, has been hailed as one of the quickest under the Group-of-20 Common Framework for Debt Treatment. Ethiopia and Zambia have also been seeking to restructure their debt under the template.

The terms of restructuring of the bilateral obligations will provide an outline for how the talks with the commercial lenders will be conducted. That’s based on the “comparability of treatment” guiding principle of the framework, which brings together Paris Club of creditors and others, including China.

Ghana halted payments on most of its external debt just over a year ago, including on $13 billion of eurobonds.

In October, it proposed as much as a 40% haircut for dollar bond investors and the issue of new instruments that would have up to 20-year maturities and a 5% coupon. But those terms will now be influenced by the Jan. 12 official creditors agreement, Ofori-Atta said.

Cut-Off Date

As part of the terms, Ghana’s partners agreed to change the cut-off date for loans that should form part of the reorganization to December 2022 from March 2020, giving the country significant bandwidth to work with all bilateral lenders, Ofori-Atta said.

They also agreed to exempt $2.8 billion of bilateral obligations from debt-service payments between 2023 and 2026, he said.

“China had its issues, the bilaterals also all had issues,” Ofori-Atta said. “At the end of the day all the parties, whatever it is they were looking for, have been fulfilled.”

The agreement clears the way for the IMF board to make a second disbursement of $600 million to Ghana under the country’s $3 billion IMF program when it meets on Jan. 19, the minister said. It will also unlock about $550 million from the World Bank, he said.

A useless groups of leaders… Who only know how to borrow until the run their nation permanently halted.. I don’t know why Ghanaians thought hatred for inter-tribal hegemony do this to Ghana by electing these clueless individuals.