Gold Overtakes Stocks as Second-Favorite Long-Term Investment

Gold has surpassed equities as the second most popular long-term investment choice amongst Americans, according to the latest poll by Gallup, a Washington, D.C.-based analytics firm.

The poll was conducted during the first two weeks of April to gauge investor sentiment around the time the Trump administration announced its sweeping tariffs, which evidently led to a massive selloff in stocks.

Amid the market chaos, gold became more attractive to investors due to its value as a safe haven. Prices have surged more than 10% since the early April onslaught, taking the metal’s yearly gains to 27%. Multiple records were set during this rally, including a recent milestone of over $3,500 an ounce.

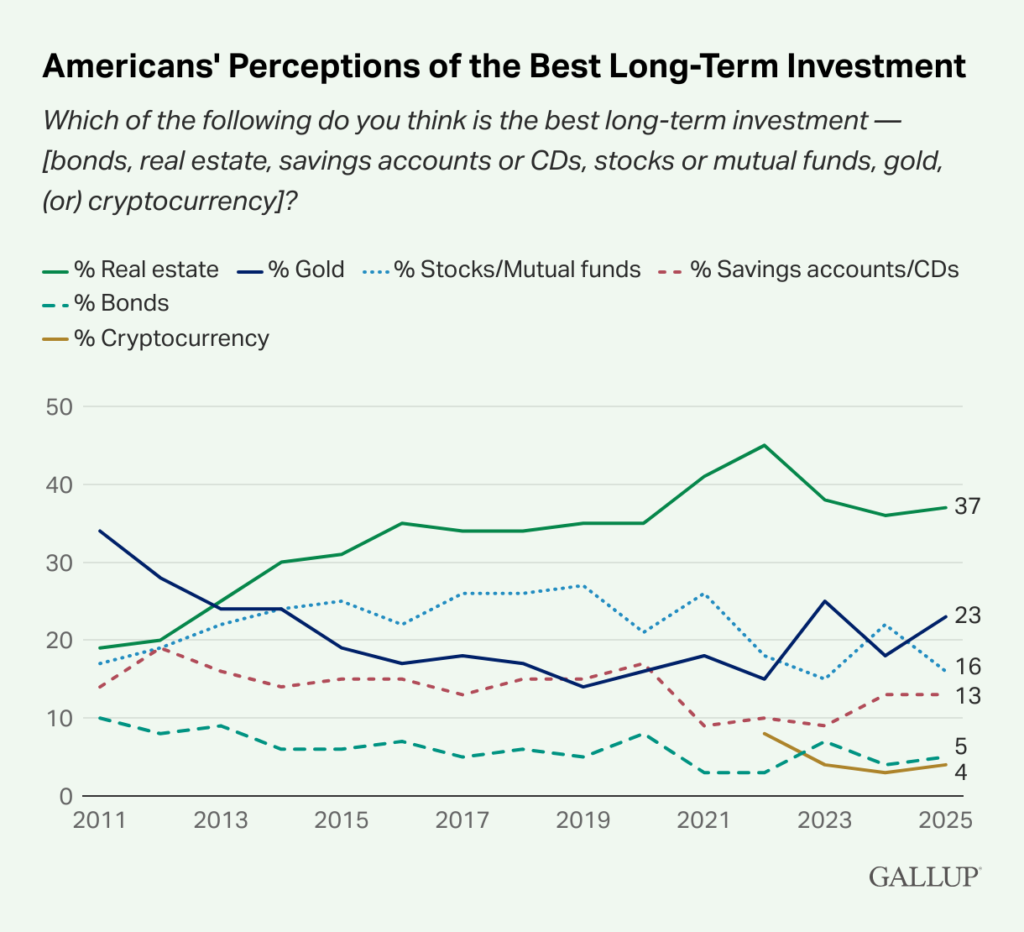

In Gallup’s annual poll, around 23% of the US adults now prefer bullion as their go-to investment, a five-point rise over last year. The increase takes gold’s popularity back near the same level in 2023, when high interest rates and geopolitical uncertainty drove investors to the metal.

Despite the increased appeal, gold remains below its record high of 34% in 2011 — when investors sought safe assets in the aftermath of the 2008 financial crisis.

Meanwhile, only 16% of the respondents prefer stocks/mutual funds, down six points from last year’s reading. The decline reverses its position with gold, dropping it back down to third place.

Americans appear to be following economic news — including tariffs and market swings — and adjusting their perceptions of investment risk accordingly, Gallup commented on its findings.

For the 12th consecutive year, real estate remains by far the top choice amongst investors of all income levels, holding steady at about 37% in the poll.

Other preferred investment assets include bonds and cryptocurrency, which had 5% and 4% respectively, both in line with last year.