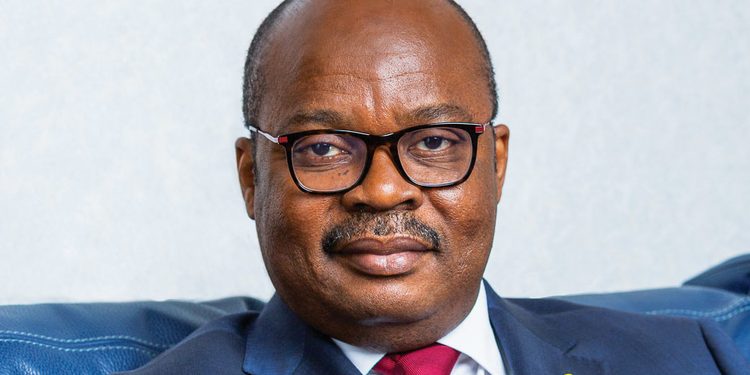

Governor of the Central Bank, Dr Ernest Addison, has assigned reasons to the exclusion of exceptional costs in the Finance Ministry’s fiscal deficit calculation of the country.

According to him, the practice introduced two years ago under the International Monetary Fund (IMF) programme, was to monitor the fiscal deficit performance of the budget.

Noting that the practice has outlived it’s purpose, the Governor noted that going forward, government will include the exceptional costs – financial sector bailout costs and energy sector arrears – in its fiscal deficit calculation.

Dr Addison made the assertion speaking at Monday’s 97th Monetary Policy Committee press briefing in Accra.

“In 2018, when we were under an IMF programme, in order to be able to monitor the budget performance, it was important that we computed the deficit to exclude the energy and financial sectors, as those were legacy problems that we had inherited.”

“Now that we have finished the programme, given the developments in 2020 in the wake of the pandemic, this is the time to relook at that area—the broader fiscal deficit which includes the energy and the financial sector issues.”

“Over the medium term, we need to redefine the broader fiscal deficit, which gives you a better sense of the burden on the budget,” he explained.

A number of people have raised concerns about the incumbent government’s method of computing its fiscal deficit as it usually is different from that of the IMF.

One person who has been vocal about this issue, is Ghana’s former Finance Minister, Seth Terkper, who has consistently accused the incumbent government of excluding the exceptional costs to show “impressive” fiscal deficit figures.

Although the 2020 fiscal deficit is officially projected at 11.8 per cent of GDP, the inclusion of additional financial sector expenses incurred during the year is likely to increase the gap to more than 13 per cent of GDP.

That notwithstanding, Dr Addison notes that he expects fiscal deficit to return to 5 per cent as mandated by the Fiscal Responsibility Act.

“The type of shock that we had in 2020 is not something that will easily be corrected. We think that we probably will revert to the fiscal rule in three years. We expect that in 2021, the budget deficit should be around 8.8 per cent of GDP, in 2022, we will see a further decline and eventually back to 5 per cent in 2023. So it’s a gradual adjustment to where we want to be,” he stated.

Meanwhile, the MPC headed by the Governor, at the press briefing, maintained its policy rate at 14.5 at per cent for the fifth consecutive time.