Gov’t to use T-Bills finance GHS 50bn budget deficit

Total government expenditure projected for the 2024 fiscal year amounts to some GHS 226bn representing approximately 21.6% of the country’s current Gross Domestic Product (GDP).

Total revenue and grants for 2024 on the other hand, are projected at GH¢176.4 billion (16.8% of GDP).

Based on the Finance Minister’s estimates for total revenue & grants and total expenditure (including arrears clearance), the overall budget balance to be financed is a fiscal deficit of GH¢50 billion, equivalent to 5.9% of GDP.

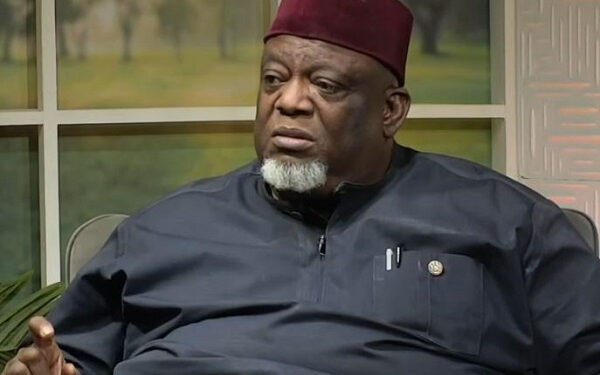

The projected deficit for 2024 according to the Director of Operations for Dalex Finance, Joe Jackson, will be mainly financed with the use of Government treasury bills.

The use of treasury bills to finance the deficit, he noted, will adversely impact businesses as it will significantly reduce the amount of credit available and accessible to businesses.

“In 2024 we expect to raise GHS 176bn and spend GHS 226bn, and that means we will be borrowing GHS 50bn.

“What should scare businesses is that T-Bills will be used to finance this deficit and not foreign money, and so there is going to be a crowding out, and where will be the access to finance that businesses are going to get next year.”

“Already, 51% of all financial sector assets are sitting in Government paper, who is going to lend to you, and at what rate? Government is borrowing at 33%, what rate do you think you will get?,” he averred speaking during a post-budget discussion on Metro TV monitored by norvanreports.

According to Mr Jackson, despite a suspension on servicing external debts since December 2022, Government, from January to August this year, spent 66% of its revenue on interest payments (25%) and salaries (41%).

By year-end, this is further projected to rise to 71.9% of Government’s revenue.

“What makes you broke is not how much debts you are carrying, but your ability to repay. Without paying external debtors, our interest payments and salaries will grow to 71.9% of revenue.

“Our behaviour hasn’t changed and so nothing will change,” he quipped.

At the recent T-Bills auction by Government, the short-term debt securities were oversubscribed by nearly GHS 480m as Government raked in GHS 3.7bn.

The secured GHS 3.7 billion was against a programmed auction target of GHS 3.2 billion.