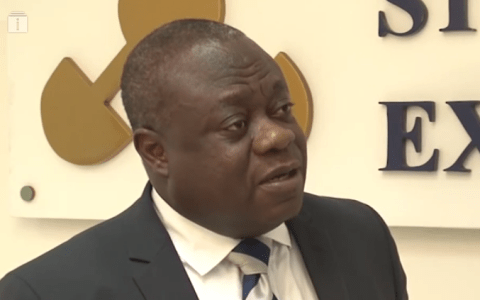

Managing Director of the Ghana Stock Exchange (GSE), Ekow Afedzie, has been appointed Co-Chair of the Africa Regional Committee of the International Capital Market Association (ICMA).

Mr Afedzie’s appointment as the Co-Chair of the ICMA was formalized at a meeting with the Committee of Regional Representatives (CRR) on December 10, 2020.

Commenting on his appointment, Mr Afedzie said, “this appointment is significant and marks the maturity of Ghana’s Bond market – the Ghana Fixed Income Market (GFIM). Being members of ICMA will enable the GFIM tap into the rich resources of the association to continually improve performance and its relevance in Ghana, Africa and the world at large.”

He noted that within the few years of its establishment, the GFIM has been ranked fourth in size for issued sovereign debt in sub Saharan Africa.

Martin Scheck, Chief Executive of ICMA also noted, “we are delighted to welcome Ekow Afedzie as Co-Chair of the Africa Committee. This is one of our fastest growing regions where there is enormous potential for capital markets to deliver economic growth to benefit all its citizens and I look forward to working with him as we take forward the excellent work of this committee.”

The GSE became a full member of the International Capital Market Association in January 2020 joining the Bank of Ghana and the Central Securities Depository to bring ICMA membership in Ghana to three.

Membership of the ICMA West Africa Sub-Committee include Ghana Stock Exchange, Bank of Ghana, Central Securities Depository, FMDQ Holdings Plc, Nigeria, African Export Import Bank, African Finance Corporation, Nigeria, Front Clear and a Secretariat provided by ICMA.

ICMA is the trade association for the international capital market with over 600 member firms from more than 60 countries, including banks, issuers, asset managers, infrastructure providers and law firms.

It performs a crucial central role in the market by providing industry-driven standards and recommendations for issuance, trading and settlement in international fixed income and related instruments.